Tennessee Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Tennessee Nonprofit & Fundraising Company Licenses

- Tennessee Individual Nonprofit & Fundraising Licenses

Company Licenses

Tennessee Nonprofit & Fundraising Company Licenses

Tennessee Charitable Gaming Licenses

Initial Registration

Tennessee Charitable Gift Annuity Registration

Initial Registration

| Form: | |

| Agency Fee: | $675 |

| Notarize: | Required |

| Notes: | Charities must maintain a separate reserve fund that contains either 110% of the reserves required by TN Code § 56-52-104(b) or the total amount of donations for outstanding charitable gift annuities. |

Registration Renewal

| Form: | There is no renewal form, instead send a letter of intent to renew to the department along with the renewal fee. |

| Agency Fee: | $100 |

| Due: | Annually by March 1. |

| Notes: | In addition to renewing the certificate of authority, charities should also submit an annual report within 90 days after the close of their fiscal year. |

Tennessee Charitable Organization Registration

Automatic Exemption

| Exemption Eligible Organizations: |

|

| Law: |

Registration to Obtain Exemption

| Exemption Eligible Organizations: | Charities with less than $50,000 in gross contributions during the preceding fiscal year |

| Form: | Form SS-6042: Annual Request for $50,000 and Under Exemption |

| Agency Fee: | $0 |

| Notes: | Charities must register within 30 days if they exceed $50,000 in contributions. |

Renewal to Maintain Exemption

| Exemption Eligible Organizations: | Charities with less than $50,000 in gross contributions during the preceding fiscal year |

| Form: | Form SS-6042: Annual Request for $50,000 and Under Exemption (Renewal) |

| Agency Fee: | $0 |

| Due: | Annually within 6 months of the organization's fiscal year end. |

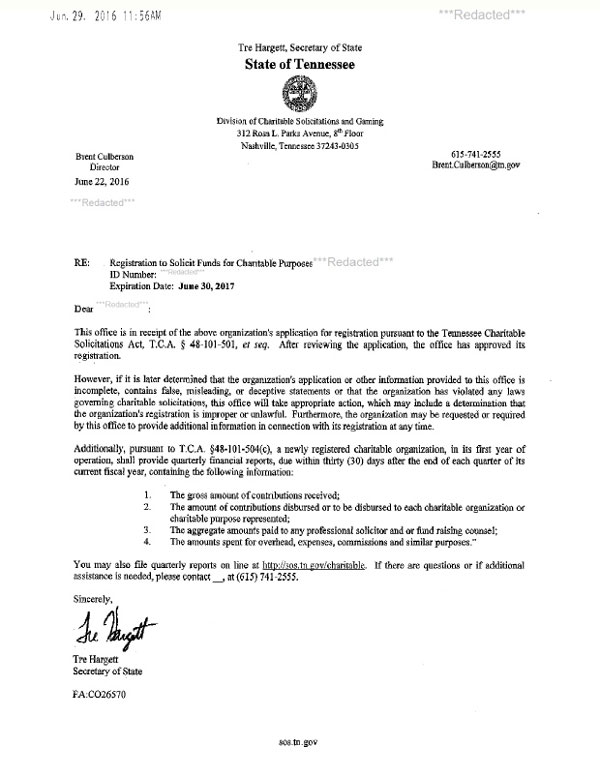

Initial Registration

| Form: | Form SS-6001: Application for Registration of a Charitable Organization |

| Instructions: | Filing instructions for registration of a charitable organization |

| Filing Method: | Mail or online. |

| Agency Fee: | $10 |

| Turnaround: | 1 month |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Form: | Form SS-6002: Application to Renew Registration of a Charitable Organization |

| Instructions: | Filing instructions for renewing registration of a charitable organization |

| Filing Method: | Mail or online. |

| Agency Fee: | $10 |

| Due: |

|

| Due Date Extension: | Due dates can be extended for 150 days beyond the original due date by submitting a request for extension through the online portal. A copy of IRS form 8868 must be included when requesting an extension. |

| Penalties: | There is a late fee of $10 for each month that passes after the due date. |

| Notes: |

|

| Required Attachments: |

|

Contract Filing

| Agency Fee: | $0 |

| Due: | Charities must submit copies of every contract they have with professional fundraisers, fundraising counsels, and commercial co-venturers during initial charitable registration and during charitable registration renewal. |

Financial Reporting

Quarterly Financial Report

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Within 30 days after the end of each quarter of the organization's current fiscal year. |

| Notes: | During their first year of operation, newly registered charitable organizations must provide quarterly financial reports to the Secretary of State. |

Change of Fiscal Year

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Notes: | Send the state a copy of the short IRS 990 once it is available. |

Cancellation

| Form: | |

| Agency Fee: | $0 |

| Notes: | To close out your registration, submit a Notice of Intent to Cease Solicitations, the most recently filed IRS form 990, and a brief letter of explanation. |

Tennessee Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Tennessee.

Tennessee does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

"Professional solicitor" means any person who, for a financial or other consideration, solicits contributions for, or on behalf of, a charitable organization, whether such solicitation is performed personally or through such person's agents, servants or employees or through agents, servants or employees specially employed by or for a charitable organization, who are engaged in the solicitation of contributions under the direction of such person, or a person who plans, conducts, manages, carries on or advises a charitable organization in connection with the solicitation of contributions. Any independent marketing agent or entity to whom a professional solicitor assigns fund raising or solicitation responsibilities shall be deemed to be a professional solicitor for purposes of this part. A salaried officer or permanent employee of a charitable organization is not deemed to be a professional solicitor. However, any salaried officer or employee of a charitable organization that engages in the solicitation of contributions for compensation in any manner for more than one (1) charitable organization is deemed a professional solicitor. A professional solicitor does not include an attorney, investment counselor, or banker who in the conduct of such person's profession advises a client. See T.C.A. §48-101-501(7).

Tennessee Professional Solicitor Registration

| Agency: | Tennessee Secretary of State - Division of Charitable Solicitations and Gaming |

| Bond Requirements: | $25,000 |

Initial Registration

| Form: | Form SS-6003: Application for Registration of a Professional Solicitor |

| Agency Fee: | $10 |

| Original Ink: | Not required |

| Notarize: | Not required |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Form: | Form SS-6003: Application for Registration of a Professional Solicitor (Renewal) |

| Agency Fee: | $10 |

| Due: | Annually by December 31. |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a solicitation campaign notice before beginning a new campaign. |

Financial Reporting

| Form: | Form SS-6022: Summary of Financial Activities for a Campaign |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and within 90 days after the end of the fiscal year for campaigns lasting more than a year. |

| Notarize: | Required |

Individual Licenses

Tennessee Individual Nonprofit & Fundraising Licenses

Tennessee Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in Tennessee.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in Tennessee.