Missouri Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Missouri Nonprofit & Fundraising Company Licenses

- Missouri Individual Nonprofit & Fundraising Licenses

Company Licenses

Missouri Nonprofit & Fundraising Company Licenses

Missouri Abbreviated Pull-Tab License

| Game Type: | Pull-tabs |

| Agency: | Missouri Gaming Commission - Charitable Gaming Division |

| Notes: | Charities can have as many as 15 pull-tab licenses over the course of a calendar year. |

Missouri Bingo License

Initial Registration

| Agency: | Missouri Gaming Commission - Charitable Gaming Division |

| Form: | |

| Agency Fee: | $50 for an annual license or $25 for a special bingo and pull-tab license. |

Registration Renewal

| Agency: | Missouri Gaming Commission - Charitable Gaming Division |

| Form: | Form 100: Missouri Bingo/Pull-Tab License Application (Renewal) |

| Agency Fee: | $50 |

| Due: | Annually |

Missouri Charitable Gift Annuity Registration

Initial Registration

| Form: | |

| Agency Fee: | $0 |

| Notes: | Missouri charities must provide notice on the day they first enter into a charitable gift annuity agreement. Notices must identify the organization, certify that the organization is a charity and that the annuities issued are qualified charitable gift annuities, and be signed by an officer or director. |

Registration Renewal

Not required

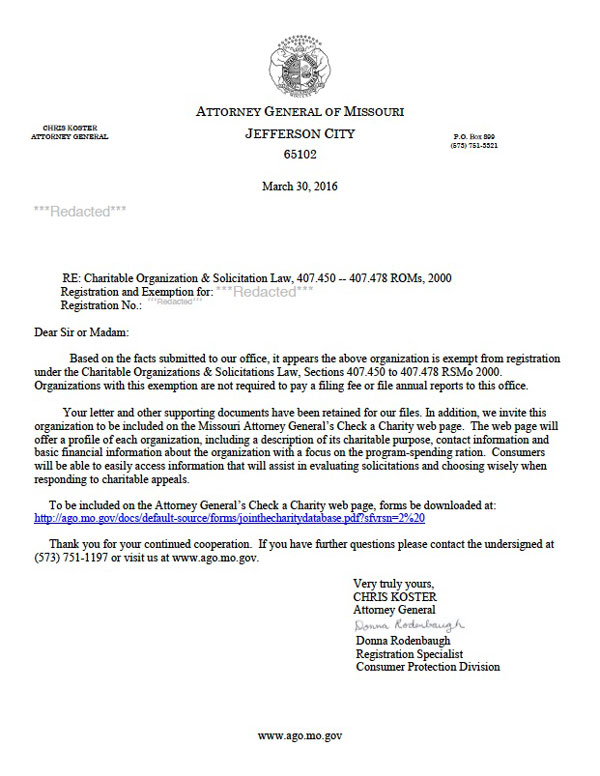

Missouri Charitable Organization Registration

| Agency: | Missouri Attorney General - Charities |

| Law: | Missouri Revised Statutes, Title XXVI, §407.450 through 407.462 |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

One-Time Exemption Registration

| Exemption Eligible Organizations: |

|

| Agency Fee: | $0 |

| Law: | |

| Original Ink: | Not required |

| Notarize: | Not required |

| Notes: | There is no application form for exemption, but charities should cite the exemption category and submit supporting documents (e.g. articles of incorporation and IRS determination letter) to receive an exemption. |

Initial Registration

| Form: | |

| Filing Method: | |

| Agency Fee: | $15, payable to "Merchandising Practices Revolving Fund" |

| Turnaround: | 1 week |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: | None |

Registration Renewal

| Form: | |

| Filing Method: | |

| Agency Fee: | $15 |

| Due: |

|

| Due Date Extension: | Missouri does not grant extensions, however, charities that will not have completed financials available by the due date can file the annual report using estimated figures. Write "estimated" on the form and submit the renewal fee and once financials become available file an updated copy of the annual report with the actual figures (no fee required to file updated financials). |

| Notes: |

|

| Required Attachments: | None |

Missouri Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Missouri.

Missouri does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

Missouri Fundraising Counsel Registration

Not required

Fundraising Counsel licensure is not required on the State level in Missouri.

Missouri does not currently have a traditional registration requirement for fundraising counsels, but they may need to follow other regulations before and after fundraising events.

Missouri Multiple Organization Bingo License

Initial Registration

| Agency: | Missouri Gaming Commission - Charitable Gaming Division |

| Form: | |

| Agency Fee: | $50 for an annual license or $25 for a special bingo and pull-tab license. |

A professional fundraiser is any person or entity who is retained under contract or otherwise compensated by or on behalf of a charitable organization primarily for the purpose of soliciting funds.

Professional fundraiser does not include any bona fide employee of a charitable organization who receives regular compensation and is not primarily employed for the purpose of soliciting funds. § 407.453, RSMo

Missouri Professional Fundraiser Registration

| Agency: | Missouri Attorney General - Charities |

Initial Registration

| Form: | |

| Agency Fee: | $50 |

| Original Ink: | Not required |

| Notarize: | Required |

| Before you Apply: |

|

Registration Renewal

| Form: | |

| Agency Fee: | $50 |

| Due: | Annually by the registration anniversary date. |

| Original Ink: | Not required |

| Notarize: | Not required |

Individual Licenses