Maryland Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Maryland Nonprofit & Fundraising Company Licenses

- Maryland Individual Nonprofit & Fundraising Licenses

Company Licenses

Maryland Nonprofit & Fundraising Company Licenses

Maryland Bingo and Raffle Licenses

Not required

Charitable Gaming licensure is not required on the State level in Maryland.

There is no state level licensing for games of chance in Maryland, however, many Maryland counties license charitable organizations for games of bingo and raffles.

Maryland Charitable Gift Annuity Registration

Initial Registration

| Agency Fee: | $0 |

| Notes: | Maryland requires charities to apply for a permit to receive exemption from state insurance laws. There is no form, but the charity should submit proof that it meets the requirements for exemption. To qualify organizations must have been in existence as a 501(c)(3) for at least 10 years and must maintain a separate fund reserve fund for annuity funds. |

Registration Renewal

| Agency Fee: | $0 |

| Due: | Annually within 90 days of the charity's fiscal year end. |

| Notes: | There is no renewal form, but charities should submit the required statements and audit to renew their permit. |

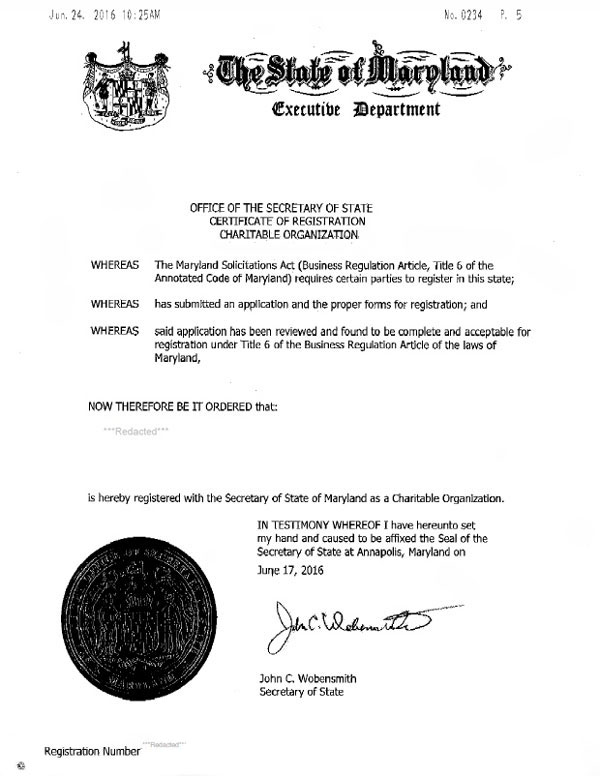

Maryland Charitable Organization Registration

| Agency: | Maryland Secretary of State - Charitable Organizations Division |

| Law: | Maryland Ann. Code, Business Regulation Article, § 6-401 et seq |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

One-Time Exemption Registration

| Exemption Eligible Organizations: |

Charitable organizations that do not use a professional solicitor and either:

Additionally, the Secretary of State may exempt from the requirement of a registration statement or annual report a charitable organization that:

|

| Law: | Maryland Ann. Code, Business Regulation Article, § 6-102 and Maryland Ann. Code, Business Regulation Article, § 6-413 |

| Notes: | There is no registration requirement, but charities must submit a letter to the Secretary of State stating their claim of an exemption. |

Registration to Obtain Exemption

| Exemption Eligible Organizations: | Charities that received less than $25,000 in contributions during their most recent fiscal year |

| Form: | |

| Agency Fee: | $0 |

Renewal to Maintain Exemption

| Exemption Eligible Organizations: | Charities that received less than $25,000 in contributions during their most recent fiscal year |

| Form: | |

| Agency Fee: | $0 |

| Due: | Annually within 8 months after fiscal year end. |

Initial Registration

| Form: | |

| Filing Method: | Mail or email to dlcharity_sos@maryland.gov. |

| Agency Fee: | $0-300, depending on charitable contributions |

| Turnaround: | 4-6 weeks |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Filing Method: | Mail or email to dlcharity_sos@maryland.gov. |

| Agency Fee: | $0-300, depending on charitable contributions |

| Due: |

|

| Due Date Extension: | Due dates are automatically extended for 4.5 months beyond the original due date. |

| Penalties: | There is a late fee of $25 for each month that passes after the due date. |

| Notes: |

|

| Required Attachments: |

|

Change of Fiscal Year

| Form: | |

| Agency Fee: | Varies |

| Notes: | Fiscal year can be changed during the standard renewal process. |

Cancellation

| Agency Fee: | $0 |

| Notes: | To close out your registration, submit articles of dissolution or a letter stating the organization is no longer soliciting in Maryland. Past due filings or fees are not required in order to close an organization's registration. |

Maryland Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Maryland.

Maryland does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

A Fund-Raising Counsel definition under Business Regulation Article, §6-101(h) is a person who is compensated for advising a charity about a solicitation in Maryland or holding, planning, or managing a solicitation in Maryland. The Fund-Raising Counsel is prohibited from directly soliciting or receiving charitable contributions.

Maryland Fund-Raising Counsel Registration

| Agency: | Maryland Secretary of State - Charitable Organizations Division |

Initial Registration

| Form: | |

| Agency Fee: | $250 |

| Before you Apply: |

|

| Required Attachments: |

|

Registration Renewal

| Form: | |

| Agency Fee: | $250 |

| Due: | Annually |

Contract Filing

| Agency Fee: | $0 |

| Due: | A Fund-Raising Counsel is required to submit a copy of each fund-raising agreement by the tenth day after the agreement is made or the start of the charitable solicitation, whichever is earlier. |

Maryland Professional Solicitor Registration

| Agency: | Maryland Secretary of State - Charitable Organizations Division |

| Bond Requirements: | $25,000 |

Initial Registration

A Professional Solicitor is a person who is compensated for advising a charity about a charitable solicitation, holding, planning, or managing a solicitation in Maryland, or soliciting or receiving contributions for a charitable organization. The solicitation or receipt of contributions is the distinction between a fund-raising counsel and Professional Solicitor.

| Form: | |

| Agency Fee: | $350 |

| Original Ink: | Not required |

| Notarize: | Not required |

| Notes: | ing Agreements In addition to completing the fund-raising notice, a solicitor is required to submit with the notice a copy of the fund-raising agreement. Business Regulation Article, §6-616 requires that agreements between Professional Solicitors and charities include the names and addresses of the parties, the minimum percentage of the gross receipts from the solicitations that will be used by the charity exclusively to advance its charitable purpose, and the text used in each solicitation. In addition to submitting a copy of any fund-raising agreements between a solicitor and a charity, the solicitor is also required to submit copies of any subcontracts or other contracts in furtherance of the agreement between the charity and solicitor. This includes the submission of caging agreements, generally defined as an agreement between a solicitor or charity and a person engaged to receive or hold contributions resulting from an agreement between a charity and solicitor. |

| Before you Apply: |

|

| Required Attachments: |

|

| Bond Amount: | $25,000 |

Registration Renewal

| Form: | http://sos.maryland.gov/Charity/Pages/Register-Professional-Solicitor.aspx |

| Agency Fee: | $350 |

| Due: | Annually |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a fundraising notice prior to starting a public solicitation campaign. |

Financial Reporting

| Form: | |

| Agency Fee: | $0 |

| Due: | A final accounting report is required within three months after the end of each fund-raising campaign and must account for all funds received and disbursed during the entire fund-raising campaign. |

Maryland Public Safety Solicitor Registration

| Agency: | Maryland Secretary of State - Charitable Organizations Division |

| Bond Requirements: | $25,000 |

Initial Registration

| Form: | |

| Agency Fee: | $100 |

| Notes: | This application must be submitted by a Public Safety Solicitor for each Public Safety Organization with which the Public Safety Solicitor contracts. |

Individual Licenses

Maryland Individual Nonprofit & Fundraising Licenses

Maryland Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in Maryland.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in Maryland.