Florida Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Florida Nonprofit & Fundraising Company Licenses

- Florida Individual Nonprofit & Fundraising Licenses

Company Licenses

Florida Nonprofit & Fundraising Company Licenses

Florida Bingo and Raffle Licenses

Not required

Charitable Gaming licensure is not required on the State level in Florida.

There is no state level licensing for games of chance in Florida, however, many Florida counties license charitable organizations for games of bingo.

Florida Charitable Gift Annuity Registration

| Agency: | Florida Office of Insurance Regulation |

| Law: | FL Stat. § 627.481 |

| Organization Age Requirement: | 5 years of continuous existence immediately preceeding licensure. |

Initial Registration

| Form: | There is no application form. |

| Agency Fee: | $0 |

| Notes: | Charities must submit a notice to the office that identifies the charity, certifies that the organization meets the requirement to issue annuities, and bear the signature of two or more officers or directors. Organizations must have a separated reserve fund and qualify as a 501(c)(3). |

Registration Renewal

| Agency Fee: | $0 |

| Due: | Annually within 60 days of the charity's fiscal year end. |

| Notes: | The charity must file annual sworn statements which follow the rules set by the office of insurance regulation. |

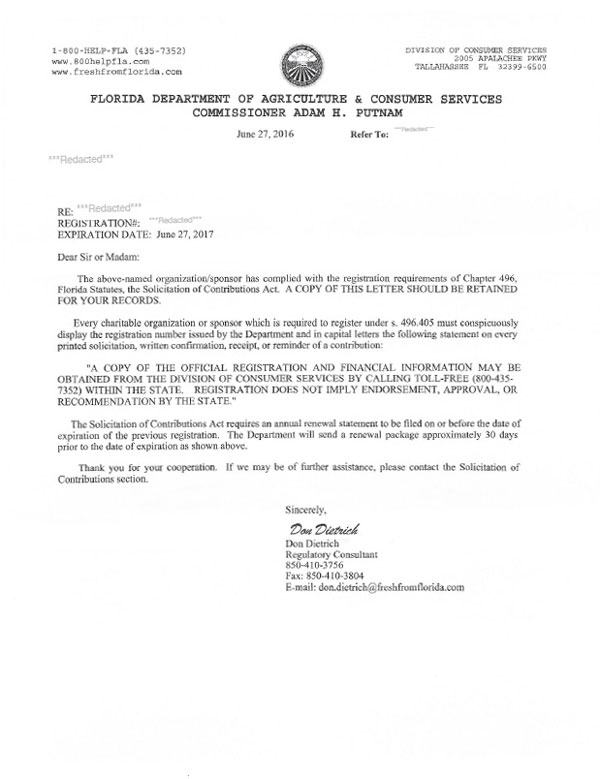

Florida Charitable Organizations/Sponsors Registration

| Agency: | Florida Department of Agriculture and Consumer Services - Division of Consumer Services |

| Law: | Florida Statutes § 496.405 et seq. |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

One-Time Exemption Registration

| Exemption Eligible Organizations: |

|

| Notes: | Organizations must email the state to receive an exemption, but no registration is required. |

Registration to Obtain Exemption

| Exemption Eligible Organizations: | Charities with less than $25,000 in total revenue during the preceding fiscal year and no professional solicitors |

| Form: | |

| Agency Fee: | $0 |

Renewal to Maintain Exemption

| Exemption Eligible Organizations: | Charities with less than $25,000 in total revenue during the preceding fiscal year and no professional solicitors |

| Form: | |

| Agency Fee: | $0 |

| Due: | Annually by the date of initial registration. |

Initial Registration

| Form: | Charitable Organizations / Sponsors Registration Application |

| Filing Method: | Mail or online |

| Agency Fee: | $10-400, depending on contributions received during the prior fiscal year ($0 if exempt) |

| Turnaround: | 2-3 weeks |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | Mail or online. |

| Agency Fee: | $10-400, depending on contributions received during the prior fiscal year |

| Due: | Annually by the registration anniversary date. Renewals may be filed up to 60 days prior to the expiration date. |

| Due Date Extension: | Due dates can be extended for 180 days beyond the original due date by submitting a request for extension through the online portal. |

| Penalties: | There is a late fee of $25 for each month that passes after the due date. |

| Notes: |

|

| Required Attachments: |

|

Contract Filing

| Agency Fee: | $0 |

| Due: | Charities must submit all contracts they have with professional solicitors, professional fundraising consultants, and commercial co-venturers during initial charitable registration and during renewal for their charitable registration. |

Change of Fiscal Year

| Agency Fee: | $0 |

| Turnaround: | 1-2 business days |

| Notes: | Email the state to inform them of the change. |

Cancellation

| Agency Fee: | $0 |

| Notes: | To close out your registration, submit a letter stating that your organization no longer solicits in Florida along with documentation supporting this claim. The department will typically accept a disclaimer on the organization's donation page that they will not accept funds from residents of Florida. |

Florida Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in Florida.

Florida does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

More information: Florida Department of Agriculture and Consumer Services - Division of Consumer ServicesProfessional fundraising consultant means a person who is retained by a charitable organization or sponsor for a fixed fee or rate under a written agreement to plan, manage, conduct, carry on, advise, consult, or prepare material for a solicitation of contributions in this state but who does not solicit contributions or employ, procure, or engage any compensated person to solicit contributions and who does not at any time have custody or control of contributions. A bona fide volunteer or bona fide employee or salaried officer of a charitable organization or sponsor maintaining a permanent establishment in this state is not a professional fundraising consultant. An attorney, investment counselor, or banker who advises an individual, corporation, or association to make a charitable contribution is not a professional fundraising consultant as the result of such advice.

Florida Professional Fundraising Consultant Registration

| Agency: | Florida Department of Agriculture and Consumer Services - Division of Consumer Services |

| Law: |

Initial Registration

| Form: | |

| Agency Fee: | $300 |

| Turnaround: | 14-21 days |

Registration Renewal

| Form: | Registration for Professional Fundraising Consultants (Renewal) |

| Agency Fee: | $300 |

| Due: | Annually |

Contract Filing

| Agency Fee: | $0 |

| Due: | Every contract or agreement between a professional fundraising consultant and a charitable organization or sponsor must be in writing, signed by two authorized officials of the charitable organization or sponsor, and filed by the professional fundraising consultant at least 5 days prior to the performance of any material service by the professional fundraising consultant. |

| Law: | |

| Notes: | Contracts must contain all of the following provisions:

|

Amendment

| Form: | |

| Agency Fee: | $0 |

| Due: | Professional Fundraising Consultants must report to the department any material change in the information filed, in writing, within 7 working days after the change occurs. |

Professional solicitor means a person who, for compensation, performs for a charitable organization or sponsor a service in connection with which contributions are or will be solicited in, or from a location in, this state by the compensated person or by a person it employs, procures, or otherwise engages, directly or indirectly, to solicit contributions, or a person who plans, conducts, manages, carries on, advises, consults, directly or indirectly, in connection with the solicitation of contributions for or on behalf of a charitable organization or sponsor but who does not qualify as a professional fundraising consultant. A bona fide volunteer or bona fide employee or salaried officer of a charitable organization or sponsor maintaining a permanent establishment in this state is not a professional solicitor. An attorney, investment counselor, or banker who advises an individual, corporation, or association to make a charitable contribution is not a professional solicitor as the result of such advice.

Florida Professional Solicitor Registration

| Agency: | Florida Department of Agriculture and Consumer Services - Division of Consumer Services |

| Law: | |

| Bond Requirements: | $50,000 |

Initial Registration

| Form: | |

| Agency Fee: | $300 |

| Notes: |

|

| Before you Apply: |

|

| Required Attachments: |

|

| Bond Amount: |

|

Registration Renewal

| Form: | Renewal forms are sent in the mail 45 days prior to expiration. |

| Agency Fee: | $300 |

| Due: | Annually |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a notice of commencement at least 15 days prior to the start of the contract. |

| Law: | |

| Notes: | Contracts must contain all of the following provisions:

|

Financial Reporting

| Agency Fee: | $0 |

| Due: | Within 45 days after a campaign has ended and within 45 days of the anniversary of commencement for campaigns lasting more than a year. |

| Notes: | Financial report forms are sent in the mail. |

Amendment

| Form: | |

| Agency Fee: | $0 |

| Due: | Licensed professional solicitors must notify the Florida Department of Agriculture and Consumer Services within 7 days of any material changes in information which was filed with the department. |

Individual Licenses

Florida Individual Nonprofit & Fundraising Licenses

Florida Individual Professional Solicitor License

| Agency: | Florida Department of Agriculture and Consumer Services - Division of Consumer Services |

| Law: |

Initial Registration

| Form: | |

| Agency Fee: | $0 |

| Original Ink: | Not required |

| Notarize: | Not required |

| Notes: | There is no registration fee, but there may be a fee for a background check. |

Registration Renewal

| Form: | Registration for Professional Solicitor Individuals (Renewal) |

| Agency Fee: | $0 |

| Due: | Annually |

| Original Ink: | Not required |

| Notarize: | Not required |

Amendment

| Form: | |

| Agency Fee: | $0 |

| Due: | Licensed professional solicitor individuals must notify the Florida Department of Agriculture and Consumer Services within 10 days of any material changes in information which was submitted as a condition for license. |