North Carolina Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- North Carolina Nonprofit & Fundraising Company Licenses

- North Carolina Individual Nonprofit & Fundraising Licenses

Company Licenses

North Carolina Nonprofit & Fundraising Company Licenses

North Carolina Bingo and Raffle Licenses

Initial Registration

| Agency: | North Carolina State Bureau of Investigation - Alcohol Law Enforcement Branch |

| Form: | Form BL-1: Application for Exempt Organization to Operate Bingo Games |

| Agency Fee: | $200 |

| Notes: | Exempt organizations may also hold as many as 2 raffle events per year, but no license is required for these. |

Registration Renewal

| Agency: | North Carolina State Bureau of Investigation - Alcohol Law Enforcement Branch |

| Form: | Form BL-1: Application for Exempt Organization to Operate Bingo Games (Renewal) |

| Agency Fee: | $200 |

| Due: | Annually |

North Carolina Charitable Gift Annuity Registration

Initial Registration

| Form: | |

| Agency Fee: | $0 |

| Notes: | North Carolina charities must provide notice within 90 days of when they first enter into a charitable gift annuity agreement. Notices must identify the organization, certify that the organization is a charity and that the annuities issued are qualified charitable gift annuities, and be signed by an officer or director. Charities must also provide their most recent IRS form 990 upon request from the department. |

Registration Renewal

Not required

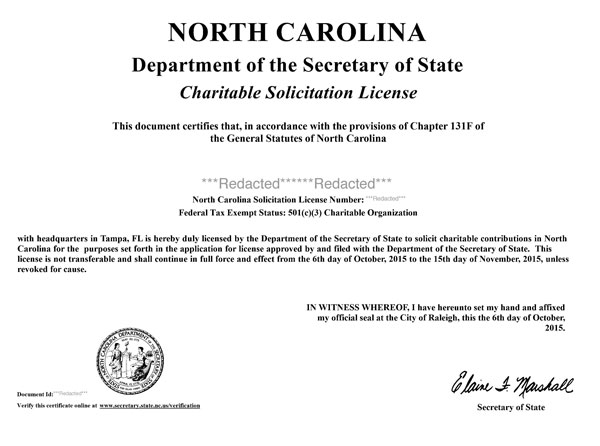

North Carolina Charitable or Sponsor Organization Solicitation License

| Agency: | North Carolina Secretary of State - Charitable Solicitation Licensing Division |

| Law: | North Carolina General Statutes §§ 131 F-2 to 131f-8. CSL Statute and Rule Reference |

| Foreign Qualification is Prerequisite: | No |

| Registered Agent (Special Agency) Required? | No |

Automatic Exemption

| Exemption Eligible Organizations: |

|

One-Time Exemption Registration

| Exemption Eligible Organizations: | Educational institutions |

| Form: | |

| Agency Fee: | $0 |

| Law: |

Registration to Obtain Exemption

| Exemption Eligible Organizations: | Charities with less than $25,000 in contributions in any calendar year |

| Form: | |

| Agency Fee: | $0 |

Renewal to Maintain Exemption

| Exemption Eligible Organizations: | Charities with less than $25,000 in contributions in any calendar year |

| Form: | |

| Agency Fee: | $0 |

| Due: | Annually within 4.5 months after the organization's fiscal year end. |

Initial Registration

| Form: | Initial / Renewal License Application for Charities or Sponsors |

| Filing Method: | Mail or online. |

| Agency Fee: | $0-200, depending on contributions |

| Turnaround: | 2-3 weeks |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Form: | Initial / Renewal License Application for Charities or Sponsors |

| Filing Method: | Mail or online. |

| Agency Fee: | $0-200, depending on contributions |

| Due: |

|

| Due Date Extension: | Due dates are automatically extended for 60 days beyond the original due date. |

| Penalties: | $25 for each month that passes after the due date. Capped at $900. |

| Notes: |

|

| Required Attachments: |

|

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | Charities must submit a disclosure form for each contract they have with fundraising consultants, professional solicitors, and commercial co-venturers during initial charitable registration and with charitable renewal filings. |

| Notes: |

|

Change of Fiscal Year

| Form: | Initial / Renewal License Application for Charities or Sponsors |

| Agency Fee: | Varies |

| Notes: | Fiscal year can be changed during the standard renewal process. |

Cancellation

| Agency Fee: | $0 |

| Notes: | Submit a letter signed by an authorized officer or member of the organization along with an IRS form 990, audited financial statement, or a completed Annual Financial Report Form for the immediately preceding fiscal year. |

North Carolina Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in North Carolina.

North Carolina does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

"Fund-raising consultant" means any person who meets all of the following:

a. Is retained by a charitable organization or sponsor for a fixed fee or

rate under a written agreement to plan, manage, conduct, consult, or

prepare material for the solicitation of contributions in this State.

b. Does not solicit contributions or employ, procure, or engage any

person to solicit contributions.

c. Does not at any time have custody or control of contributions

North Carolina Fund Raising Consultant Registration

| Agency: | North Carolina Secretary of State - Charitable Solicitation Licensing Division |

Initial Registration

| Form: | |

| Agency Fee: | $200 |

| Notarize: | Required |

Registration Renewal

| Form: | |

| Agency Fee: | $200 |

| Due: | Annually by March 31. |

| Notarize: | Required |

Contract Filing

| Form: | |

| Agency Fee: | $0 |

| Due: | File a contract checklist at least 5 days prior to the start of each solicitation campaign. |

North Carolina Professional Solicitor Registration

| Agency: | North Carolina Secretary of State - Charitable Solicitation Licensing Division |

| Bond Requirements: | Bond requirement ranges from $20,000-$50,000. |

Initial Registration

| Form: | |

| Agency Fee: | $200 |

| Turnaround: | 10 Days |

| Notarize: | Required |

| Notes: | For non-NC corporations: Provide either of the following to verify the applicant’s current legal existence:

For un-incorporated applicants: Provide a copy of your assumed name certificate filed with the register of deeds office, showing the register of |

| Required Attachments: |

|

Registration Renewal

| Form: | Professional Solicitor Application Initial/Renewal (Renewal) |

| Agency Fee: | $200 |

| Due: | Annually by March 31. |

Contract Filing

| Form: | Solicitor Contract Checklist and Solicitation Campaign Notice |

| Agency Fee: | $0 |

| Due: | File a solicitation campaign notice and contract checklist at least 5 days prior to the start of each solicitation campaign. |

Financial Reporting

| Form: | |

| Agency Fee: | $0 |

| Due: | Within 90 days after a campaign has ended and on the anniversary of commencement for campaigns lasting more than a year. |

| Notarize: | Required |

Individual Licenses

North Carolina Individual Nonprofit & Fundraising Licenses

North Carolina Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in North Carolina.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in North Carolina.