Washington D.C. Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- Washington D.C. Nonprofit & Fundraising Company Licenses

- Washington D.C. Individual Nonprofit & Fundraising Licenses

Company Licenses

Washington D.C. Nonprofit & Fundraising Company Licenses

District of Columbia Bingo License

Initial Registration

District of Columbia Charitable Gift Annuity Registration

Not required

Charitable Gift Annuity licensure is not required on the State level in District of Columbia.

The District of Columbia does not distinguish between annuities issued by charitable and for-profit entities.

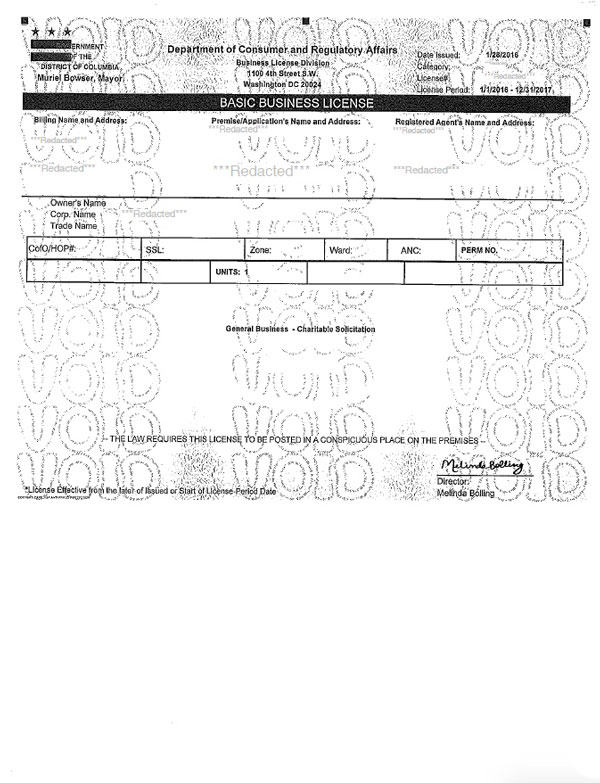

District of Columbia Charitable Solicitation License

| Agency: | District of Columbia Department of Consumer and Regulatory Affairs - Business Licensing Division |

| Law: | |

| Foreign Qualification is Prerequisite: | Yes |

| Registered Agent (Special Agency) Required? | Yes |

Registration to Obtain Exemption

| Exemption Eligible Organizations: |

|

| Filing Method: | |

| Agency Fee: | $0 |

Renewal to Maintain Exemption

| Exemption Eligible Organizations: |

|

| Filing Method: | |

| Agency Fee: | $0 |

| Due: | Biennially by the end of the month prior to your registration month. If you registered for the first time in September, your report will be due by the end of August two years later. |

Initial Registration

| Filing Method: | |

| Agency Fee: | $412.50 |

| Turnaround: | 3-4 weeks |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | |

| Agency Fee: | $412.50 |

| Due: |

|

| Due Date Extension: | D.C. does not grant extensions for charitable organization registration. |

| Required Attachments: | None |

Cancellation

| Filing Method: | |

| Agency Fee: | $0 |

| Notes: | To close out your registration, submit a BBL cancellation request form online. |

District of Columbia Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in District of Columbia.

District of Columbia does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

District of Columbia Fundraising Counsel Registration

Not required

Fundraising Counsel licensure is not required on the State level in District of Columbia.

District of Columbia does not currently have a traditional registration requirement for fundraising counsels, but they may need to follow other regulations before and after fundraising events.

District of Columbia Monte Carlo Night Party License

| Game Type: | Monte Carlo games |

| Agency: | District of Columbia Office of Lottery and Charitable Games |

| Notes: | Charities cannot hold more than 2 Monte Carlo events in a calendar year. |

Initial Registration

District of Columbia Professional Fundraiser Registration

Not required

Professional Fundraiser licensure is not required on the State level in District of Columbia.

District of Columbia does not currently have a traditional registration requirement for professional fundraisers, but they may need to follow other regulations before and after fundraising events.

District of Columbia Raffle License

Initial Registration

Registration Renewal

Individual Licenses

Washington D.C. Individual Nonprofit & Fundraising Licenses

District of Columbia Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in District of Columbia.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in District of Columbia.