North Dakota Fundraising Licensing

Below, you'll find licensing requirements for a range of fundraising activities. At a glance, you can see requirements, fees, filing instructions, and links to forms for everything from charitable gaming and cause marketing to professional fundraisers and charitable gift annuities.

Make sure your fundraising activities meet the unique requirements of each jurisdiction where you’re soliciting. Feel free to explore, bookmark, and share!

- Jump To:

- North Dakota Nonprofit & Fundraising Company Licenses

- North Dakota Individual Nonprofit & Fundraising Licenses

Company Licenses

North Dakota Nonprofit & Fundraising Company Licenses

North Dakota Certificate of Exemption to Issue Gift Annuities

| Agency: | North Dakota Insurance Department |

| Law: | ND Century Code § 26.1-34.1 et seq. |

Initial Registration

| Form: | Form SFN 17914: Application for Certification of Exemption to Issue Gift Annuities |

| Agency Fee: | $100 |

| Notarize: | Required |

| Notes: | Charities should submit the application, agent of process attachment, segregated account attachment, statements reflecting financial and other conditions of the organization, proof of tax exemption, and samples of the charitable annuity contracts to apply. |

Renewal Not Required

Not required

The certificate of exemption does not expire, but financial statements must be submitted annually.

Financial Reporting

| Filing Method: | Email financial statements to colicexam@nd.gov with the subject line of "Gift Annuity Financial Statement". |

| Agency Fee: | $0 |

| Due: | Audited (or unaudited if audited are unavailable) financial statements are due annually within 15 days of their preparation. |

North Dakota Charitable Gaming Licenses

Initial Registration

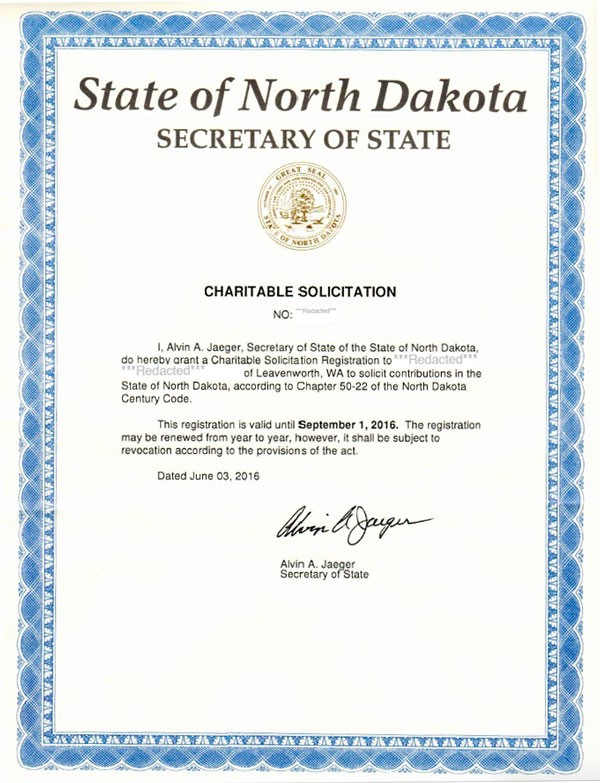

North Dakota Charitable Organization Registration

| Agency: | North Dakota Secretary of State |

| Law: | |

| Foreign Qualification is Prerequisite: | Yes |

| Registered Agent (Special Agency) Required? | No |

One-Time Exemption Registration

| Exemption Eligible Organizations: |

|

| Law: |

Initial Registration

| Filing Method: | |

| Agency Fee: | $25. Out-of-state nonprofits will also incur fees to qualify and appoint a registered agent. |

| Turnaround: | 4-6 weeks |

| Notes: |

|

| Before you Apply: | Domestic Applicants:

Foreign Applicants:

|

| How to Apply: | Domestic Applicants:

Foreign Applicants:

|

| Required Attachments: |

|

Registration Renewal

| Filing Method: | |

| Agency Fee: | $10 |

| Due: | Annually by September 1. If you initially apply in July or August, you get a waiver until the following September. |

| Due Date Extension: | Due dates can be extended for 90 days beyond the original due date by submitting an amendment through the online portal. |

| Required Attachments: |

|

Change of Fiscal Year

| Filing Method: | |

| Agency Fee: | $10 |

| Notes: | Changes to the fiscal year of a charity can be reported through the online portal. |

Cancellation

| Notes: | To close out your registration, either file a final report with “Final” across the top of front page and submit it with a $10 filing fee (if you haven’t filed the charity annual report for this year yet) or simply send an e-mail requesting the cancellation (if you have already filed a report for this year). |

North Dakota Commercial Co-Venturer Registration

Not required

Commercial Co-venturer licensure is not required on the State level in North Dakota.

North Dakota does not currently have a traditional registration requirement for commercial co-venturers, but they may need to follow other regulations before and after fundraising events.

"Professional fundraiser" means a person who, for financial compensation or profit,

performs for a charitable organization a service in connection with which contributions

are, or will be, solicited in this state by the compensated person or by a compensated

person the person employs, procures, or engages to solicit; or a person who for

compensation or profit plans, manages, advises, consults, or prepares material for, or

with respect to, the solicitation in this state of contributions for a charitable

organization. A bona fide full-time salaried officer or employee of a charitable

organization maintaining a permanent establishment within the state may not be

deemed to be a professional fundraiser.

An attorney, investment counselor, or banker who advises any person to make a

contribution to a charitable organization may not be deemed, as the result of that

advice, to be a professional fundraiser.

North Dakota Professional Fundraiser Registration

| Agency: | North Dakota Secretary of State |

| Law: | |

| Bond Requirements: | $20,000 |

Initial Registration

Professional Fundraiser Registration

| Form: | |

| Agency Fee: | $100 |

| Original Ink: | Not required |

| Notarize: | Not required |

| Notes: | A copy of all contracts with charitable organizations must be submitted with the application. |

Registration Renewal

Professional Fundraiser Registration Renewal

| Form: | Form SFN 11303: Professional Fundraiser Application (Renewal) |

| Agency Fee: | $100 |

| Due: | Annually by August 31. |

| Original Ink: | Not required |

| Notarize: | Not required |

Contract Filing

| Agency Fee: | $0 |

| Due: | After the filing of the Professional Fundraiser Registration, any contracts entered into with any charitable organizations must be submitted to the Secretary of State within 10 days of the execution of those contracts. |

Individual Licenses

North Dakota Individual Nonprofit & Fundraising Licenses

North Dakota Individual Professional Fundraiser Registration

Not required

Professional Solicitor licensure is not required on the State level in North Dakota.

Solicitors who are not employed by a professional fundraising firm but operate independently may be required to register. Employees of professional fundraising firms are generally not required to register as an individual solicitor in North Dakota.