-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

How to File Indiana Articles of Incorporation

Your Guide to Incorporating in Indiana

Indiana articles of incorporation are filed to create a corporation. This guide provides instructions and tips when preparing and filing this legal document.

Incorporate NowOverview

Preparing and filing your articles of incorporation is the first step in starting your business or nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation. Only after this approval can the corporation apply for tax IDs, obtain business licenses, sign contracts, and otherwise conduct business.

Incorporating provides many important benefits:

- Limits the liability of directors, officers, and shareholders

- Fulfills statutory requirements to register your business’s or organization’s name

- Provides governance and adds credibility to the business or organization

As you prepare to file your articles of incorporation, take time to understand the specific information required on those documents. Documents prepared by non-professionals are rejected for a number of common reasons such as not including a corporate suffix and not providing a valid registered agent address. This guide will help. When in doubt, consult theIndiana Code (IC).

State articles of incorporation templates represent the minimum amount of information you must provide for state approval, but there might be additional provisions you should provide. The IRS requires additional provisions for 501(c)(3) eligibility. State tax exemptions, licenses, B-corporation and other certifications, and even some banking purposes require additional provisions in the articles.

Quick Facts about Incorporating

Who should incorporate in Indiana?- Profit corporations

- Nonprofit corporations

- Professional corporations

Is an attorney required?

No, using an attorney is not required. You can file yourself or consider one of our incorporation packages.

What does it cost to incorporate?

Profit corporations: $80 online, $90 by mail

Nonprofit corporations: $25 online, $30 by mail

How long does the process take?

Online: in hours.

Walk-in and express mail: 1 business day

Mail: 3-5 business days.

Fax: 24 hours.

Who processes articles of incorporation?

Indiana Secretary of State Business Services Division

What is the governing statute?

Indiana Code (IC)

Business Corporations

Profit corporations and professional corporations

How to File Articles of Incorporation for a Business Corporation

Indiana profit articles of incorporation include the following information. Differences for professional corporations are noted. Certain accounting, architectural, engineering, attorneys, health care professionals, veterinarians, and real estate professionals are authorized to form a professional corporation in Indiana (IC 23-1.5-2-3. Note that some information is optional.

1

Pursuant to Provisions

Specify whether you wish to form a profit corporation or professional corporation. A profit corporation should

indicate that it is forming a corporation pursuant to the provisions of Indiana Business Corporation Law. A

professional corporation should indicate that it is forming a corporation pursuant to the provisions of the Indiana

Professional Corporation Act 1983, IC 23-1.5-1-1 and the following.

2

Name and Principal Office

The name of your corporation must be distinguishable from all other registered names in Indiana. This includes other

corporate names, professional corporate names, nonprofit corporate names, limited partnership names, reserved names,

and some fictitious names. Conduct a thorough name availability check before filing your articles of

incorporation.

Your corporate name must contain the word “corporation”, “incorporated”, “company”,

or “limited”, or the abbreviation “corp.”, “inc.”, “co.”, or “ltd.”,

or words or abbreviations of like import in another language. Professional corporations must include the

words “Professional Services Corporation” or “Professional Corporation” or an abbreviation

of these words.

Include the address of the principal office of the corporation.

3

Registered Agent

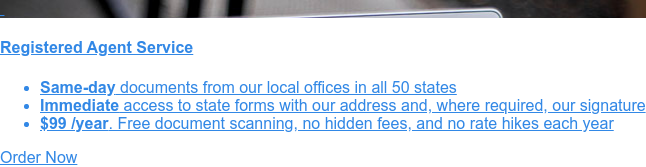

The corporation’s registered agent is the individual or company who is responsible for receiving service of

process (notice of lawsuit) and other official correspondence on behalf of the corporation. Deliveries to the

registered agent are often made in-person from a designated official, require signature, and are

time-sensitive.

Your Indiana articles of incorporation must name the corporation’s registered

agent and registered office. This individual or company must provide prior consent to serve as your registered

agent. A named individual must be a resident of Indiana. Hiring an Indiana registered

agent service is useful if you have a home office, are regularly out of the office, wish to keep your

address off the public record, or do not want to risk receiving a sheriff or process server in front of clients or

employees.

The registered office address must be a street address, located in Indiana, and not a P.O. Box (unless accompanied

by a rural route reference).

The corporation may not serve as its own registered agent. Your corporation may only have one agent.

4

Authorized Shares

Shares represent ownership interest in the corporation. State the total number of shares the corporation is

authorized to issue.

You do not have to issue all shares authorized, that way you have the flexibility to add more shareholders at a

later date. In the example of a corporation with three owners, you may authorize 1,000 shares and issue 250 shares

to each owner (750 shares issued). This leaves 250 shares to issue to future investors or partners. The corporation

may later change the amount of shares authorized by filing an amendment to the articles of incorporation.

The corporation may choose to issue more than one class of share (e.g. Class A, Class B) with distinct rights and

preferences. If so, detail out the designations, rights, preferences, and authorized shares per class.

5

Incorporator(s)

The incorporator is the individual responsible for executing the articles of incorporation. The function of the incorporator usually ends after the documents are filed. More than one incorporator may be used. Each incorporator must print their name and address. Remember that any information you provide will become part of public record so you may wish to use a business location. Each incorporator must sign and date the articles of incorporation to execute them.

*

Optional Provisions

You may choose to include additional statements in the articles of incorporation. Be aware that any information you include will become part of public record.

- The name and address of the preparer of the articles of incorporation.

- The names and addresses of the initial directors.

- The purpose or purposes for which the corporation is organized.

- Provisions regarding managing the business and regulating the affairs of the corporation.

- Defining, limiting and regulating the powers of the corporation, its board of directors and shareholders.

- A par value for authorized shares or classes of shares.

- The imposition of personal liability on shareholders for the debts of the corporation to a specified extent and upon specified conditions.

- By default, the articles of incorporation will be effective when the Indiana Secretary of State files them. You may specify a future effective date.

Supplementary Documents a Business Corporation May File with the Articles of Incorporation

Certificate of Registration

Professional Corporations must include a Certificate of Registration from the appropriate licensing authority.

Right to Corporate Name

If your corporate name is not distinguishable from others, you may file court judgment showing your right to the name.

Filing Fees

Include filing fees ($80 online, $90 by mail) made payable to “Secretary of State”.

Indiana Tips for Filing by Mail

- Use 8.5"x11" white paper for all documents.

- Send original and one copy of articles.

How to Elect S-Corporation Status

S-Corporation is a tax election filed with the IRS. By default, your corporation will receive tax treatment as a C-Corporation. Many small businesses find it beneficial to elect S-Corporation tax treatment.

- Electing Subchapter S status helps shareholders avoid the double taxation that applies to traditional C-Corporations.

- S-Corps can also help the owners avoid paying the 15.3% Self-Employment Tax (Social Security and Medicare) on distributions.

Corporations must file form IRS-2553 within 75 calendar days of incorporation to be taxed as an S-Corp. Check with your state’s Department of Revenue if they will automatically recognize your federal IRS tax election or if you need to make an additional application or notification.

Nonprofit Corporations

How to File Articles of Incorporation for a Nonprofit Corporation

You can form an Indiana nonprofit corporation by filing the articles of incorporation forms intended for a nonprofit. Nonprofit articles must contain the following information:

1

Name and Principal Office

The name of your corporation must be distinguishable from all other registered names in Indiana. This includes other

nonprofit and profit corporate names, professional corporate names, limited partnership names, reserved names, and

some fictitious names. Conduct a thorough name availability check before filing your articles of incorporation.

Your corporate name must contain the word “corporation”, “incorporated”, “company”,

or “limited”, or the abbreviation “corp.”, “inc.”, “co.”, or “ltd.”,

or words or abbreviations of like import in another language.

Include the address of the principal office of the corporation.

2

Purpose

Describing the purpose for which the nonprofit corporation is organized is optional. If you will apply for 501(c)(3) federal tax exemption, you will need to provide a description. Consider using the language prescribed for your desired exemption in IRS Pub Rev-557.

3

Type of Corporation

Determine if your organization is a religious, public benefit, or mutual benefit corporation. State this in the articles as, for example, “This corporation is a public benefit corporation.”.

- Religious Corporations are used primarily for religious purposes. They may apply for tax exemption under 501(c)(3).

- Public Benefit Corporations are those serve the community at large such as volunteer firefighter departments, grantmaking foundations, and homeless shelters. Any non-religious organization that will apply for exemption under 501(c)(3) is a public benefit corporation.

- Mutual Benefit Corporations serve a limited number of members with common interests. For example, your organization might be a homeowners’ association, snowmobile club, or trade association. These corporations will not apply for tax exemption under 501(c)(3), but may apply for other tax exemptions.

4

Registered Agent and Registered Office

The corporation’s registered agent is the individual or company who is responsible for receiving service of

process (notice of lawsuit) and other official correspondence on behalf of the corporation. Deliveries to the

registered agent are often made in-person from a designated official, require signature, and are

time-sensitive.

Your Indiana articles of incorporation must name the corporation’s registered

agent and registered office. This individual or company must provide prior consent to serve as your registered

agent. A named individual must be a resident of Indiana. Hiring an Indiana registered

agent service is useful if you have a home office, are regularly out of the office, wish to keep your

address off the public record, or do not want to risk receiving a sheriff or process server in front of clients or

employees.

The registered office address must be a street address, located in Indiana, and not a P.O. Box (unless accompanied

by a rural route reference).

The corporation may not serve as its own registered agent. Your corporation may only have one agent.

5

Membership

Declare whether the corporation will or will not have members. Members of a nonprofit corporation are like the shareholders of a business corporation.

6

Incorporator(s)

The incorporator is the individual responsible for executing the articles of incorporation. The function of the incorporator usually ends after the documents are filed. More than one incorporator may be used. Each incorporator must print their name and address. Remember that any information you provide will become part of public record so you may wish to use a business location. Each incorporator must sign and date the articles of incorporation to execute them.

7

Distribution of Assets on Dissolution or Final Liquidation

Describe how the nonprofit will distribute assets if the corporation is dissolved (terminated). Completing this section is mandatory. Indiana Code 23-17-22-5 restricts the nonprofits options. Furthermore, if your organization will apply for tax exemption under 501(c), be sure to abide by the restrictions and guidance in IRS Pub Rev-557.

8

Optional Provisions

You may choose to include additional statements in the articles of incorporation. Be aware that any information you include will become part of public record.

- The name and address of the preparer of the articles of incorporation.

- Further description of the corporate purpose or purposes.

- The names and addresses of the initial directors.

- Provisions regarding managing the business and regulating the affairs of the corporation.

- Defining, limiting and regulating the powers of the corporation, its board of directors and shareholders.

- The characteristics, qualifications, rights, limitations and obligations attaching to each or any class of members.

Finally, understand that in general federal and state tax exemptions often require specific language in the articles of incorporation. It is best to research and use the exact language required by your tax-exemption or tax-deductible application in each state and with each agency where you will apply.

Supplementary Documents a Nonprofit Corporation May File with the Articles of Incorporation

Right to Corporate Name

If your corporate name is not distinguishable from others, you may file court judgment showing your right to the name.

Filing Fees

Include filing fees ($25 online, $30 by mail) made payable to “Secretary of State”.

Indiana Tips for Filing by Mail

- Use 8.5"x11" white paper for all documents.

- Send original and one copy of articles.

How to Register for 501(c)(3), Fundraising, and State Tax Exemption

501(c)(3) Federal income tax exemption

Nonprofits may choose to apply for federal income tax exemption. 501(c)(3) recognition also allows donors to make tax deductible contributions. The IRS published rev-557, an informational resource on how to obtain tax exempt status for a nonprofit organization. 501(c)(3) is perhaps the most common and well-known tax exemption category for charitable organizations, however the internal revenue code has exemption categories for many other types of nonprofits organizations. Incorporating the nonprofit and obtaining a Federal Tax ID (EIN) are precursors to applying for 501(c)(3) recognition.

State tax exemptions

501(c)(3) recognition provides income tax exemption on federal taxes. Your state may have additional applications or processes for obtaining state tax exemptions for the corporation. Consider applying for exemptions in each state where the nonprofit will conduct activities.

State fundraising registration

Some aspects of fundraising are regulated by state government. Nonprofits that solicit funds may need to submit registrations with the department of state or revenue in each state where they solicit residents. Be sure to check the procedures for obtaining the authority to solicit, employee solicitors, or otherwise engage in fundraising in each state where you raise funds.

Additional Requirements for Indiana Corporations

Indiana Does Not Have a Publishing Requirement

In some states, corporations are required to publish notice of their intention to or their filing of the articles of incorporation. This is not the case in Indiana.

Indiana Business Entity Reports

All corporations must file business entity reports.

- Profit corporations file biennially (every two years) in the anniversary month of filing the articles of incorporation. The filing fee is $22.44 online or $30 by mail.

- Nonprofit corporations file annually in the anniversary month of filing the articles of incorporation. The filing fee is $7.14 online or $10 by mail.

The Indiana Secretary of State mails reminders 90 and 30 days prior to the due date, but note that many states have ceased sending reminders. Failure to file the business entity report can result in administrative dissolution of the corporation.

Register for Federal Taxes, State Taxes, & Licenses/Permits

After you file your articles of incorporation, you will apply for a Federal Tax ID (EIN), a unique nine-digit number assigned by the IRS to identify your business. State tax registration requirements vary, but the most common registrations are for sales tax and employer taxes. You may also need to get local licenses or permits.

Hold an Organization Meeting & Establish Records

Once the registration process is complete, you should hold an organizational meeting of the incorporators and take minutes of that meeting. At that time, you will ratify corporate bylaws, adopt a shareholders agreement, issue stock certificates and complete a stock ledger, elect directors and officers, and anything else you may want to include. Consider purchasing our corporate kit that stores your documents and contains your corporate seal and stock certificates.

Ongoing Compliance Requirements

Ongoing requirements include annual meetings with minutes, special meetings to make important business decisions, maintaining a registered office, amending your articles of incorporation as needed, and more. For more information on business compliance action items, please consult your Harbor Compliance representative.