-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

How to File Arizona Articles of Incorporation

Your Guide to Incorporating in Arizona

Arizona articles of incorporation are filed to create a corporation. This guide provides instructions and tips when preparing and filing this legal document.

Incorporate NowOverview

Preparing and filing your articles of incorporation is the first step in starting your business or nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation. Only after this approval can the corporation apply for tax IDs, obtain business licenses, sign contracts, and otherwise conduct business.

Incorporating provides many important benefits:

- Limits the liability of directors, officers, and shareholders

- Fulfills statutory requirements to register your business’s or organization’s name

- Provides governance and adds credibility to the business or organization

Your final Arizona articles of incorporation package should contain:

- Cover sheet

- Articles of incorporation

- Director attachment (if applicable)

- Incorporator attachment (if applicable)

- Certificate of disclosure with applicable attachments

- Payment

Navigating Arizona Types of Corporations

The AZCC offers forms and instructions to help with incorporating. Use the correct forms and instructions depending on your type of corporation.

- Profit corporations are general business corporations.

- Professional corporations are licensed professionals (such as lawyers) authorized to incorporate. Its corporate purpose is to render the specified professional services. (see ARS Title 10 - Chapter 20)

- Business development corporations (see ARS Title 10 - Chapter 21) are formed to:

- Assist, promote, encourage and, through the cooperative efforts of the shareholders and the members of the corporation, develop and advance the business prosperity and economic welfare of Arizona.

- Encourage and assist in the location of new business and industry in Arizona.

- Rehabilitate existing business and industry in Arizona.

- Stimulate and assist in the expansion of all kinds of business activity which will tend to promote the business development and maintain the economic stability of the state, provide maximum opportunities for employment, encourage thrift, and improve the standard of living of the citizens of the state.

- Cooperate and act in conjunction with other organizations, public or private, the objects of which are the promotion and advancement of industrial, commercial, agricultural or recreational development of the state.

- Furnish money and credit to approved and deserving applicants for the promotion, development and conduct of all kinds of business activity in the state, thereby establishing a source of capital and credit not otherwise readily available therefor.

- Close corporations are generally held privately by a small number of parties, such as family members. (see ARS Title 10 - Chapter 18)

- Nonprofit corporations are general nonprofit organizations. (see ARS Title 10 - Chapter 25)

- Electric cooperative nonprofit membership corporations (see ARS Title 10 - Chapter 19) may be organized for any

of the following purposes:

- Supplying, purchasing, marketing, selling, transmitting or distributing electric energy to persons and promoting and extending the use of electric energy.

- Providing billing, metering, communications and other services related or incidental to supplying, providing or transmitting electric energy, whether or not the cooperative is itself supplying or transmitting that energy.

- Engaging in activities designed to promote economic development of rural areas as described in section 10-2057.

- Engaging in activities for any lawful purpose.

- Corporate soles may be formed to acquire, hold and dispose of church or religious society property for the benefit of religion, for works of charity and for public worship, and of property of scientific research institutions maintained solely for pure research and without expectation of pecuniary gain or profit, in the manner provided in this article. (ARS 10-11901)

The terms C-Corporation and S-Corporation refer to tax treatments, not legal structures. After forming a profit corporation, by default the business will receive C-Corp tax treatment unless you elect S-Corp tax treatment with the IRS.

Before Filing Your Articles of Incorporation

As you prepare to file your articles of incorporation, a couple words of caution:

First, take time to understand the specific information required. Articles prepared by non-professionals are

rejected for a number of common reasons such as not including a corporate suffix and not providing a valid

registered agent address. This guide will help. If in doubt, consult the Arizona Revised Statutes

(ARS) or a Harbor representative.

State articles of incorporation templates represent the minimum amount of information you must provide for state approval, but there might be additional provisions you should provide. The IRS requires additional provisions for 501(c)(3) eligibility. State tax exemptions, licenses, B-corporation and other certifications, and even some banking purposes require additional provisions in the articles. This guide provides general education on optional provisions.

Quick Facts

Who should incorporate in Arizona?- Profit corporations

- Nonprofit corporations

- (Profit) Professional corporations

Is an attorney required?

No, using an attorney is not required. You can file yourself or we can help.

What does it cost to incorporate?

Profit: $60

Professional: $60

Nonprofit: $40

Expedited: +$35 total

How long does the process take?

See current state procesing times for expedited and non-expedited filings.

Who processes articles of incorporation?

Arizona Corporation Commission (AZCC) Corporate Division (not the Arizona Secretary of State)

What is the governing statute?

Arizona Revised Statutes (ARS)

Business Corporations

Profit corporations, professional corporations, business development corporations, and close corporations

How to File Articles of Incorporation for a Business Corporation

Arizona has one articles of incorporation template for profit and professional corporations. Differences for

professional corporations are called out in the instructions and hints below. Note that some information is

optional.

To form a business development or close corporation, see the sections dedicated to mandatory articles for these

corporate types.

1

Entity Type

Here “entity” simply means “corporation”. Indicate whether you are creating a for-profit corporation or professional corporation.

2

Entity Name

Provide the exact corporate name you desire including spelling, capitalization, and punctuation.

The name of your corporation must be distinguishable from all other registered names in Arizona. This includes all

other corporate names, reserved corporate names, fictitious names adopted by foreign corporations in Arizona,

limited liability company names, limited partnership names, registered limited liability partnership names, and

trade names. Conduct a thorough name availability search. Reserving the name prior to filing the articles of

incorporation is not required.

Your corporate name...

- Must contain the word “association”, “bank”, “company”, “corporation”, “limited”, or “incorporated”, or an abbreviation of one of those words

- Must NOT contain the words “limited liability company” or “limited company” or the abbreviations “L.L.C.”, “L.C.”, “LLC” or “LC”, in uppercase or lowercase letters.

- Professional corporations must contain the words “professional corporation”, “professional association”, “service corporation”, “limited” or “chartered” or one of the following abbreviations: “P.C.”, “P.A.”, “S.C.”, “Ltd.”, “Chtd.”, “PC”, “PA”, “SC”, “Ltd”, or “Chtd”.

If you are attempting to convert a trade name you own into the name of your corporation, attach Articles of Incorporation Trade Name Declaration form M003.

3

Professional Services

Professional corporations must state the professional service(s) the corporation will provide.

4

Character of Business

Briefly describe the type of the business of the corporation actually intends to conduct in Arizona. This statement is required by all corporations and in no way limits the authority of the business the corporation may conduct.

5

Shares

Shares represent ownership interest in the corporation. Your corporation must have at least one. State the total

number of shares the corporation is authorized to issue. Stating the initial par value per share is optional.

You may wish to authorize more shares than you will issue to current owners, that way you have the flexibility to

add more shareholders at a later date. In the example of a corporation with three owners, you may authorize 1,000

shares and issue 250 shares to each owner (750 shares issued). This leaves 250 shares to issue to future investors

or partners. In Arizona, you also have the option of not actually issuing any of the authorized shares. The

corporation may later change the amount of shares authorized by filing an amendment to the articles of

incorporation.

Your Arizona articles of incorporation require shares and par values described per class and per series. Small

businesses tend to have one class of shares called “common”. Additional classes of shares (e.g. “preferred”)

would have different privileges and rights. Similarly, a series is a subdivision of a class of shares. For example,

common stock might be divided into Series A having one vote per share and Series B having 10 votes per share.

Use the Shares Authorized Attachment form C087 as needed.

6

Arizona Known Place of Business (KPB) Address

Statutes require the corporation to have a KPB street address at all times in the records of the AZCC. The penalty is administrative dissolution. It is not really clear how the state of Arizona uses this address, if at all. You have the option to state that your KPB street address (not P.O. box) is the same as your statutory agent street address (see #8). This option is the most efficient. Providing a separate address publishes more information about your corporation in the public records of the state and provides another data point your corporation will have to maintain going forwards.

7

Directors

Directors are the individuals elected by the shareholders to oversee the management of the corporation. The Board of Directors elects corporate officers to run the day-to-day operations and make certain decisions for the corporation. List the name and business address of each initial director. Remember that this information will be publicly available. As needed, complete and attach form C082 Director Attachment.

8

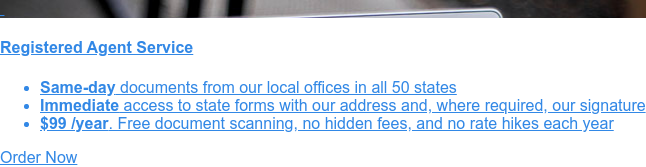

Statutory Agent

In many states the “statutory agent” is known as a “registered agent.” This individual or

business accepts service of process (lawsuit papers or legal documents) on behalf of the corporation. In other

words, if your corporation is ever sued or called to court, a process server will go to the statutory agent’s

address, deliver a document in exchange for a signature, and then the agent will send it along to the appropriate

contact at your corporation.

In Arizona the registered agent may be an individual, corporation (not itself), or LLC. An individual must be a

permanent full-time resident of Arizona who can generally be available at their “permanent, full-time Arizona

physical or street address” (AZCC C010i). Hiring an Arizona registered agent

company is useful if you are regularly out of the office, wish to keep your address off the public record,

or do not want to risk receiving a process server in front of clients or employees.

Arizona articles of incorporation must contain the agent’s name and street address. You may optionally provide

a separate mailing address and an “attention to” line for the street address of a corporation or

LLC.

You must complete and attach Statutory Agent Acceptance form M002 in which the statutory agent accepts their

appointment in writing.

9

Incorporator(s)

The incorporator is the individual responsible for executing the articles of incorporation. The function of the incorporator usually ends after the documents are filed. More than one incorporator may be used. Each incorporator must print their name, street address (not a post office box), and mailing address (if different). Remember that any information you provide will become part of public record so you may wish to use a business location. Each incorporator must sign the articles of incorporation to execute them. A signature consists of a printed name, signed name, title or capacity, and date.

10

Optional Provisions

You may choose to include additional statements in the articles of incorporation (certificate of formation). Be aware that any information you include will become part of public record.

- The name and address of the preparer of the articles of incorporation.

- Reservation to the shareholders of the right to adopt the initial bylaws of the corporation.

- Provisions regarding managing the business and regulating the affairs of the corporation.

- Defining, limiting and regulating the powers of the corporation, its board of directors and shareholders.

- A par value for authorized shares or classes of shares.

- A provision eliminating or limiting the liability of a director to the corporation or its shareholders for money

damages for any action taken, or any failure to take any action, as a director, except liability for

- (A) the amount of a financial benefit received by a director to which he or she is not entitled;

- (B) an intentional infliction of harm on the corporation or the shareholders;

- (C) a violation of Section 10A-2-8.33;

- (D) an intentional violation of criminal law; or

- (E) a breach of the director’s duty of loyalty to the corporation or its shareholders.

Supplementary Documents a Business Corporation May File with the Articles of Incorporation

Cover Sheet

All documents must be submitted with a cover sheet.

Director Attachment

If applicable, attach the direction attachment form with more space to list the initial directors.

Incorporator Attachment

If applicable, attach the incorporator attachment form with more space to list the incorporators.

Statutory Agent Acceptance

The statutory agent must sign this attachment accepting their appointment.

Certificate of Disclosure

Obtain the template for this requied attachement from the A.C.C. Remember to also include any required attachments to this form.

Filing Fees

Include all filing fees.