-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

How to File Alaska Articles of Incorporation

Your Guide to Incorporating in Alaska

Alaska articles of incorporation are filed to create a corporation. This guide provides instructions and tips when preparing and filing this legal document.

Incorporate NowOverview

Preparing and filing your articles of incorporation is the first step in starting your business or nonprofit corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation. Only after this approval can the corporation apply for tax IDs, obtain business licenses, sign contracts, and otherwise conduct business.

Incorporating provides many important benefits:

- Limits the liability of directors, officers, and shareholders

- Fulfills statutory requirements to register your business’s or organization’s name

- Provides governance and adds credibility to the business or organization

Alaska articles of incorporation are used to apply for a new corporation based in Alaska. This legal document is

filed with the Alaska Division of Corporations, Business, and Professional Licensing (CBPL). Upon approval, the

government creates a new corporate legal entity domiciled in Alaska and issues a Certificate of Incorporation.

Preparing and filing this legal document is the first step in starting your profit or nonprofit corporation.

Only after you receive approval from the Alaska CBPL should you start using your corporate name to apply for tax

IDs, obtain business licenses, sign contracts, and otherwise conduct business.

This guide walks you through preparing and filing your Alaska articles of incorporation to get your profit or

nonprofit corporation approved.

Why Incorporate

Incorporating provides several important benefits.

- Registers and reserves your business or organization’s name

- Shields the personal assets of the directors, officers, and shareholders

- Enables a nonprofit organization to apply for 501(c)(3) and other tax exemptions

- Provides additional tax benefits

- Adds credibility to the business or organization

- Continues to exist after a shareholder or director passes away or leaves

How to Incorporate

The process of incorporating is overseen by the State of Alaska - Department of Commerce, Community, & Economic

Development - Division of Corporations, Business and Professional Licensing. For short, we call this the Alaska

CBPL.

The Alaska CBPL offers several forms and instructions to help with incorporating. Use the correct forms and

instructions for a profit, nonprofit, professional, cooperative, or religious corporation.

As you prepare to file your articles of incorporation, it is important to take time to understand the specific

information required on those documents as well as information that is optional for those documents. State articles

of incorporation templates represent the minimum amount of information required by the Alaska CBPL to provide

approval. The IRS requires certain additional provisions for 501(c)(3) eligibility. State tax exemptions,

B-corporation and other certifications, and some banking purposes require additional provisions in the

articles.

You have three options to prepare and file your articles of incorporation. You can do it yourself, hire an attorney,

or hire a professional document preparation and filing service such as us.

Quick Facts

Who should incorporate in Alaska?- Profit corporations

- Nonprofit corporations

- Professional corporations

- Cooperative corporations

- Religious corporations

Is an attorney required?

No, using an attorney is not required. You can file yourself or we can help.

What does it cost to incorporate?

Alaska charges $250 to process your for-profit, professional, or cooperative articles of incorporation. Nonprofit and religious articles of incorporation cost $50.

How long does the process take?

Profit, cooperative, and nonprofit articles can be filed online and will be processed immediately. These and other corporations may be filed by mail. Mail processing times are typically 10-15 business days for complete and correct applications. All filings are processed first come, first served; expedited filing services are not available.

Profit Corporations (Business Corporations)

Profit corporations and professional corporations

How to File Articles of Incorporation for a Profit Corporation

Alaska profit articles of incorporation include the following information. Differences for professional corporations are noted. Note that some information is optional.

1

Name of Corporation

The name of your corporation must be distinguishable from all other registered entities in Alaska (including other

corporations, LLCs, and LPs). Conduct a thorough name availability check before filing your articles of

incorporation. Business names must include a corporate suffix such as “corporation”, “incorporated”, “company”, “limited”,

or a similar abbreviation. The corporation may not use a word or phrase in its name that indicates or implies that

the corporation is organized for a purpose other than the purpose contained in its articles of incorporation.

Names of professional corporations also have the option of using the suffix “professional corporation”

or a similar abbreviation. The names of professional corporations must contain the surname of at least one present

or former shareholder, unless the regulating professional board permits otherwise. Contact your licensing board for

their requirements.

2

Purpose of the corporation

Alaska permits a general declaration of purpose such as “any lawful purpose” Alternatively, you may

declare a more specific purpose or purposes.

Only the following professional services may incorporate as a professional corporation and the description of the

corporate purpose should comply.

- Acupuncturist

- Architect, Engineer, Land Surveyor

- Audiologist

- Chiropractor

- Dental

- Dispensing Optician

- Geologist

- Legal Services

- Marital Family Therapy

- Medical

- Naturopath

- Nursing

- Optometry

- Pharmacy

- Physical/Occupational Therapy

- Physicians Assistant

- Professional Counselor

- Psychology

- Public Accountant

- Social Work

- Veterinary

3

NAICS Code

Provide the 6-digit North American Industry Classification System (NAICS) industry grouping code that most accurately describes the initial activities of the corporation. This must not conflict with the corporate purpose.

4

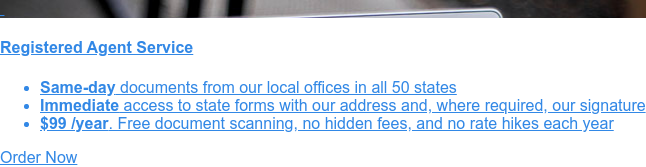

Registered Agent

You are required to declare your registered agent on your Alaska articles of incorporation. The registered agent is the individual or company responsible for receiving and forwarding processes, notices, or demands to the last known address of the corporation. For example, if your corporation is sued, the registered agent would receive a sheriff or process server to sign for the notice of lawsuit.

- You may declare any Alaska resident who consents to their appointment

- You may declare a corporation that is registered and in good standing with the Alaska CBPL who agrees to serve as your registered agent. Your corporation cannot name itself as its own registered agent. Hiring a registered agent service may be in your best interest if you have a home office, are regularly out of the office, or wish to keep your address off the public record, or do not want to risk receiving a sheriff or process server in front of clients or employees.

In the articles of incorporation, list the name of the agent, their physical address, and their mailing address. Both addresses must be located in Alaska.

5

Address

Professional corporations must state the corporation’s office address. Other corporations may optionally provide an address.

6

Alien Affiliates

You are required to disclose the name and address of each alien affiliate or indicate that there are none.

Alaska Statutes §10.06.990 define “alien” as:

- (A) an individual who is not a citizen or national of the United States, or who is not lawfully admitted to the United States for permanent residence, or paroled into the United States under the Immigration and Nationality Act (8 U.S.C. 1101 - 1525, as amended);

- (B) a person, other than an individual, that was not created or organized under the laws of the United States or of a state, or whose principal place of business is not located in any state; or

- (C) a person, other than an individual, that was created or organized under the laws of the United States or of a state, or whose principal place of business is located in a state, and that is controlled by a person described in (A) or (B) of this paragraph;

Alaska Statutes §10.06.990 define “affiliate” as “a person that directly or indirectly through one or more intermediaries controls, or is controlled by, or is under common control with, a corporation subject to this chapter”.

7

Directors, Officers, & Shareholders

Professional corporations must list the names, mailing addresses, and license numbers of all initial directors, officers, and shareholders. Only shareholders may be officers and directors. Consider using a business or post office box address for the mailing address (as opposed to a residence) since this information will be part of public record. Also list the professional license number issued by the Department of Commerce, Community, and Economic Development, or include a copy of the license if it was issued by the Alaska State Bar Association. This item does not apply to non-professional corporations.

8

Authorized Shares & Par Value

Shares represent ownership interest in the corporation. The articles of incorporation must contain several declarations regarding shares:

- State the aggregate number of shares the corporation is authorized to issue. “Zero” is not acceptable. You do not have to issue all shares authorized, that way you have the flexibility to add more shareholders at a later date. In the example of a corporation with three owners, you may authorize 1,000 shares and issue 250 shares to each owner (750 shares issued). This leaves 250 shares to issue to future investors or partners. The corporation may later change the amount of shares authorized by filing an amendment to the articles of incorporation.

- Indicate volumes of shares authorized, split by common or preferred shares, per class, and per series.

- Declare the par value(s). “Par value” is the nominal value or dollar value of the original cost of a share and has no relation to market value. For example, if the par value is $2/share then the corporation should receive $200 when it first issues 100 shares of stock to an investor. If the stock is not issued right away, the value of this stock may change.

9

Incorporator(s)

The incorporator is the individual responsible for executing the articles of incorporation. The function of the incorporator usually ends after the documents are filed. The incorporator must be a natural person of at least 18 years of age. More than one incorporator may be used. Each incorporator must print their name, sign, and date their signature of the articles of incorporation.

*

Additional Provisions

You may choose to include additional provisions that are in compliance with Alaska Statutes § 10.06.210. Be

aware that any information you include will become part of public record.

The Alaska CBPL articles of incorporation instructions do a good job describing the additional provision options for

profit corporations. Reference the Alaska statutes for allowable provisions for professional corporations. The

following is copied from the Alaska CBPL dometic profit articles of incorporations instructions verbatim.

- Any of the following provisions, that are not effective unless expressly provided in the articles:

- A provision granting, with or without limitations, the power to levy assessments upon the shares or class of shares;

- A provision removing from shareholders preemptive rights to subscribe to any or all issues of shares or securities;

- Special qualifications of persons who may be shareholders;

- A provision limiting the duration of the corporation's existence to a specified date;

- A provision restricting or eliminating the power of the board or of the outstanding shares to adopt, amend, or repeal provisions of the bylaws as provided in AS 10.06.228;

- A provision requiring, for any corporate action except as provided in AS 10.06.460 and AS 10.06.605, the vote of a larger proportion or of all of the shares of a class or series, or the vote or quorum for taking action of a larger proportion or of all of the directors, than is otherwise required by this chapter;

- A provision limiting or restricting the business in which the corporation may engage or the powers that the corporation may exercise or both;

- A provision conferring upon the holder of an evidence of indebtedness, issued or to be issued by the corporation, the right to vote in the election of directors and on any other matters on which shareholders may vote;

- A provision conferring on shareholders the right to determine the consideration for which shares shall be issued;

- A provision requiring the approval of the shareholders or the approval of the outstanding shares for a corporate action, even though not otherwise required by this chapter;

- A provision that one or more classes or series of shares are redeemable as provided in AS 10.06.325;

- Duties, privileges, and liabilities of directors upon delegates under AS 10.06.450;

- A provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for the breach of fiduciary duty as a director; the articles of incorporation may not eliminate or limit the liability of a director for (i) a breach of a director's duty of loyalty to the corporation or its stockholders; (ii) acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; (iii) willful or negligent conduct involved in the payment of dividends or the repurchase of stock from other than lawfully available funds; or (iv) a transaction from which the director derives an improper personal benefit; the provisions of this paragraph do not eliminate or limit the liability of a director for an act or omission that occurs before the effective date of the articles of incorporation or of an amendment to the articles of incorporation authorized by this paragraph;

- Reasonable restrictions upon the right to transfer or hypothecate shares of a class or series, but a restriction is not binding on shares issued before the adoption of the restriction unless the holders of those shares voted in favor of the restriction;

- The names and addresses of the persons appointed to act as initial directors;

- Any other provision not in conflict with this chapter for the management of the business and for the conduct of the affairs of the corporation, including any provision that is required or permitted by this chapter to be stated in the bylaws.

Supplementary Documents a Profit Corporation May File with the Articles of Incorporation

Contact Information Sheet

Alaska CBPL provides a contact information sheet used to resolve issues with your filing.

Optional provisions/articles

Additional articles may be attached on separate pages. Number these articles consistently and in continuation of the numbering scheme established in the articles of incorporation templates.

Copy of Alaska State Bar licenses

For a professional corporation, include a copy of any licenses issued by the Alaska State Bar Association to the officers, directors, or shareholders.

Benefit Corporations (B-Corporations)

In many states, legislation is being considered and passed to allow a new type of corporation called a benefit corporation. B-corporations are certified to meet rigorous standards of social and environmental performance, accountability, and transparency. As of the writing of this article in July 2013, B-Corps are not yet part of the Alaska corporate statutes. If your business wishes to consider becoming a B-Corp, check the latest legislation because typically B-Corps are required to include additional provisions or supplements with their articles of incorporation.

How to Elect S-Corporation Status

S-Corporation is not a type of corporation as much as a tax election. By default, your corporation will receive tax treatment as a C-Corporation. Many small businesses elect S-Corporation tax treatment.

- Electing Subchapter S status helps shareholders avoid the double taxation that applies to traditional C-Corporations.

- S-Corps can also help the owners avoid paying the 15.3% Self-Employment Tax (Social Security and Medicare) on distributions.

Corporations must file form IRS-2553 within 75 calendar days of incorporation to be taxed as an S-Corp. Check with your state’s Department of Revenue if they will automatically recognize your federal IRS tax election or if you need to make an additional application or notification.

Nonprofit Corporations

Nonprofit and religious corporations

How to File Articles of Incorporation for a Nonprofit Corporation

You can form an Alaska nonprofit corporation by filing the articles of incorporation forms intended for a nonprofit.

Use the religious or general nonprofit articles of incorporation templates as appropriate. A religious corporation

may be formed for acquiring, holding, or disposing of church or religious society property, for the benefit of

religion, for works of charity and education, and for public worship (Alaska Statutes §10.40.010).

Nonprofit articles must contain the following information:

1

Name of Corporation

The name of your corporation must be distinguishable from all other registered entities in Alaska (including other corporations, LLCs, and LPs). Conduct a thorough name availability check before filing your articles of incorporation. Inlcluding a corporate suffix such as “corporation”, “incorporated”, “company”, “limited”, or a similar abbreviation is optional. The corporation may not use a word or phrase in its name that indicates or implies that the corporation is organized for a purpose other than the purpose contained in its articles of incorporation.

2

Purpose of the corporation

Alaska permits a general declaration of purpose such as “any lawful purpose” If you will apply for 501(c)(3) or other IRS tax exemption, you must usually list a more specific corporate purpose in order to qualify.

3

NAICS Code

Provide the 6-digit North American Industry Classification System (NAICS) industry grouping code that most accurately describes the initial activities of the corporation. This must not conflict with the corporate purpose. Religious corporations do not need to provide this.

4

Property value

Only religious corporations must provide an estimated value of corporate property. Use the value of the corporate property at the time of executing the articles of incorporation.

5

Registered Agent

You are required to declare your registered agent on your Alaska articles of incorporation. The registered agent is the individual or company responsible for receiving and forwarding processes, notices, or demands to the last known address of the corporation. For example, if your corporation is sued, the registered agent would receive a sheriff or process server to sign for the notice of lawsuit.

- You may declare any Alaska resident who consents to their appointment

- You may declare a corporation (not LLC, LP, or LLP) that is registered and in good standing with the Alaska CBPL who agrees to serve as your registered agent. Your corporation cannot name itself as its own registered agent. Hiring a registered agent service may be in your best interest if you have a home office, are regularly out of the office, or wish to keep your address off the public record, or do not want to risk receiving a sheriff or process server in front of clients or employees.

In the articles of incorporation, list the name of the agent, their physical address, and their mailing address. Both addresses must be located in Alaska.

6

Directors

This item only applies to non-religious corporations. Directors are the individuals elected by the members to oversee the management of the corporation. Alaska nonprofit corporations are required to have at least three initial directors on the board. Specify the number of initial directors then list the name and mailing address for each director. Remember that the articles will become part of Alaska CBPL public record, so you may wish to use a business or post office address for the mailing address.

7

Incorporators / Signature of Authorized Person

Nonprofit corporations must list at least three incorporators. An incorporator is an individual responsible for

executing the articles of incorporation. The function of the incorporator usually ends after the documents are

filed. Each incorporator must be a natural person of at least 19 years of age. Each incorporator must print their

name, sign, and date their signature of the articles of incorporation.

Articles of incorporation for a religious corporation must be executed by an authorized person. This person can

be “an archbishop, bishop, president, trustee in trust, president of stake, president of congregation,

overseer, presiding elder, or clergyman, of a church or religious society, who has been chosen, elected or

appointed, in conformity with the constitution, canons, rites, regulations, or discipline of the church or religious

society, and in whom is vested the legal title to the property of the church or religious society.”

Furthermore, signing should be acknowledged before an officer.

*

Additional Provisions

You may choose to include additional provisions that are in compliance with Alaska Statutes. Be aware that any information you include will become part of public record. Reference the Alaska statutes for permissible provisions.

- If you are looking to become a 501(c)(3) tax exempt organization, you will need to include statements required

by the IRS. These statements are to the effect of the following:

- The corporation is not for profit

- It will not engage in prohibited political or legislative activity listed in 501(c)(3)

- If dissolved, it will distribute its assets in compliance with 501(c)(3)

- Similarly, state tax exemptions often require additional language in your articles of incorporation. It is best to research and use the exact language required by your tax-exemption or tax-deductible application in each state where you will apply.

- Obtaining certain licenses, permits, or other government classifications sometimes requires other provisions listed on your articles of incorporation. Check with the governing board or agency.

Supplementary Documents a Nonprofit Corporation May File with the Articles of Incorporation

Contact Information Sheet

Alaska CBPL provides a contact information sheet used to resolve issues with your filing.

Optional provisions/articles

Additional articles may be attached on separate pages. Use a consistent numbering scheme throughout the articles of incorporation.

Corporate subtype

Alaska cemetery corporations are one example of a corporate subtype. Reference the Alaska statutes for available subtypes and guidelines on declaring the necessary articles to confirm to the subtype.

How to Register for 501(c)(3), Fundraising, and State Tax Exemption

501(c)(3) Federal income tax exemption

Nonprofits may choose to apply for federal income tax exemption. 501(c)(3) recognition also allows donors to make tax deductible contributions. The IRS published rev-557, an informational resource on how to obtain tax exempt status for a nonprofit organization. 501(c)(3) is perhaps the most common and well-known tax exemption category for charitable organizations, however the internal revenue code has exemption categories for many other types of nonprofits organizations. Incorporating the nonprofit and obtaining a Federal Tax ID (EIN) are precursors to applying for 501(c)(3) recognition.

State tax exemptions

501(c)(3) recognition provides income tax exemption on federal taxes. Your state may have additional applications or processes for obtaining state tax exemptions for the corporation. Consider applying for exemptions in each state where the nonprofit will conduct activities.

State fundraising registration

Some aspects of fundraising are regulated by state government. Nonprofits that solicit funds may need to submit registrations with the department of state or revenue in each state where they solicit residents. Be sure to check the procedures for obtaining the authority to solicit, employee solicitors, or otherwise engage in fundraising in each state where you raise funds.

Cooperative Corporations

How to File Articles of Incorporation for a Cooperative Corporation

A cooperative corporation places more control of the corporation in the hands of the employees or patrons. This model is appropriate for local food cooperatives and others with a community-based mindset. Alaska cooperative articles of incorporation include the following information. Note that some information is optional.

1

Name of Corporation

The corporation’s name must contain the word “cooperative” or similar abbreviation. The name must be distinguishable from all other registered entities in Alaska (including other corporations, LLCs, and LPs). Conduct a thorough name availability check before filing your articles of incorporation.

2

Duration

Most corporations indicate a “perpetual” duration, meaning there is not specific termination date of the corporate entity. Alternatively, you may indicate a future end date up to 100 years in the future.

3

Purpose of the corporation

Alaska permits a general declaration of purpose such as “any lawful purpose” Alternatively, you may declare a more specific purpose or purposes. Cooperatives may not be formed for the purposes of banking, insurance, or furnishing electric or telephone service.

4

NAICS Code

Provide the 6-digit North American Industry Classification System (NAICS) industry grouping code that most accurately describes the initial activities of the corporation. This must not conflict with the corporate purpose.

5

Registered Agent

You are required to declare your registered agent on your Alaska articles of incorporation. The registered agent is the individual or company responsible for receiving and forwarding processes, notices, or demands to the last known address of the corporation. For example, if your corporation is sued, the registered agent would receive a sheriff or process server to sign for the notice of lawsuit.

- You may declare any Alaska resident who consents to their appointment

- You may declare a corporation (not LLC, LP, or LLP) that is registered and in good standing with the Alaska CBPL who agrees to serve as your registered agent. Your corporation cannot name itself as its own registered agent. Hiring a registered agent service may be in your best interest if you have a home office, are regularly out of the office, or wish to keep your address off the public record, or do not want to risk receiving a sheriff or process server in front of clients or employees.

In the articles of incorporation, list the name of the agent, their physical address, and their mailing address. Both addresses must be located in Alaska.

6

Membership

List whether the cooperative is organized with or without membership stock. List the membership fee. List the limitations, if any, on transferring membership.

7

Stock

Provide information on the stock the corporation is authorized to issue.

- Membership stock: This section only applies to cooperatives that have membership stock. Organizations with membership stock must indicate the number of authorized shares of membership stock by class and series. Also indicate the par value. Also indicate any restrictions on transferring membership.

- Capitol stock: Indicate the number of authorized shares of capitol stock by class and series. Also indicate the par value. If more than one class is issued, list the designation, preferences, limitations, and relative rights of each class. Describe any limitations on transferring each class of stock.

- Provide any restrictions on the right to acquire or recall stock (membership or capitol).

8

Distribution of Assets

In the event of a dissolution or liquidation of the corporation, describe how the corporation’s assets will be distributed.

9

Directors

Cooperative Alaska articles of incorporation must list at least three directors. For each director, provide their title, name, and mailing address. Remember that the articles of incorporation will be made public record, so consider using a business or post office address, as opposed to a residence, for the mailing address. The directors listed are the initial directors; they may be replaced at the first annual meeting of the shareholders or when successors are otherwise duly qualified and elected.

10

Incorporators

Cooperative corporations must list at least three incorporators. An incorporator is an individual responsible for executing the articles of incorporation. The function of the incorporator usually ends after the documents are filed. Each incorporator must be a natural person of at least 19 years of age. Each incorporator must print their name, sign, and date their signature of the articles of incorporation.

*

Additional Provisions

You may choose to include additional provisions that are in compliance with Alaska Statutes. Reference the Alaska statutes for allowable provisions for cooperative corporations.

Supplementary Documents a Cooperative Corporation May File with the Articles of Incorporation

Contact Information Sheet

Alaska CBPL provides a contact information sheet used to resolve issues with your filing but not filed with the articles of incorporation.

Optional provisions/articles

Additional articles may be attached on separate pages. Number these articles consistently and/or in continuation of the numbering scheme established in the articles of incorporation templates.

Additional Requirements for Alaska Corporations

Alaska Does Not Have a Publishing Requirement

In some states, corporations are required to publish notice of their intention to or their filing of the articles of incorporation. This is not the case in Alaska.

Alaska Initial & Biennial Reports

All new corporations must file an initial report within 6 months with the Alaska CBPL. These can be filed online or by mail for no fee. Thereafter, Alaska corporate reports are due every other year by January 2nd. The state does not send out reminders for biennial reports. Biennial filing fees are $100 and late penalties commence February 1st.

Alaska Business License

All new corporations must obtain an Alaska business license. Applications are made with the Alaska CBPL.

Alaska Corporate Net Income Tax

Alaska corporations are responsible for remitting corporate net income tax on gross receipts to the Alaska Department of Revenue. Certain corporations can be exempted.

Register for Federal Taxes, State Taxes, & Licenses/Permits

After you file your articles of incorporation, you will apply for a Federal Tax ID (EIN), a unique nine-digit number assigned by the IRS to identify your business. State tax registration requirements vary, but the most common registrations are for sales tax and employer taxes. You may also need to get local licenses or permits.

Hold an Organization Meeting & Establish Records

Once the registration process is complete, you should hold an organizational meeting of the incorporators and take minutes of that meeting. At that time, you will ratify corporate bylaws, adopt a shareholders agreement, issue stock certificates and complete a stock ledger, elect directors and officers, and anything else you may want to include. Consider purchasing our corporate kit that stores your documents and contains your corporate seal and stock certificates.

Ongoing Compliance Requirements

Ongoing requirements include annual meetings with minutes, special meetings to make important business decisions, maintaining a registered office, amending your articles of incorporation as needed, and more. For more information on business compliance action items, please consult your Harbor Compliance representative.