Start a Business in Missouri

Helpful Tools

LLC, C-Corp, or S-Corp?

Choose which one is right for you.

Limiting Your Liability

Do you need liability insurance, limited liability protection, or both?

Welcome to Our Community

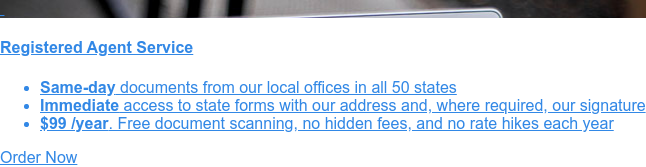

We're committed to publishing free informational resources such as this how-to guide. Our resources have been shared by important industry organizations including:

This guide on starting your business in Missouri provides step-by-step instructions on the paperwork to file formation documents, obtain tax IDs, and set up company records.

Step-By-Step Startup

Below is an overview of the paperwork, cost, and time to form each of the most popular business structures. Simply click on the link for your desired structure to view detailed step-by-step instructions.

- If you have not decided whether you want to form an LLC, corporation, or other business structure, click here.

- If wish to form your business in a different state than Missouri, click here.

| Structure | Paperwork | Cost | Time |

|---|---|---|---|

|

Missouri Limited Liability Company Click for step-by-step instructions |

|

|

|

|

Missouri Corporation Click for step-by-step instructions |

|

|

|

|

Missouri Nonprofit Click for step-by-step instructions |

|

|

|

Top 5 Tips on Registering a Business in Missouri

- You must submit original signatures on your Missouri Secretary of State formation documents.

- Get your EIN from the IRS before trying to register with the Missouri Department of Revenue. They will issue your business state tax id(s) and accounts.

- An initial report is due 30 days of incorporating. LLCs need not file an initial report.

- The incorporation filing fee can be confusing. It is $58 for up to $30,000 authorized shares. Plus an $5 additional for every $10,000 or authorized shares over $30,000. The way you calculate the dollar value of authorized shares is this: multiply the number of authorized shares by the par value per share. So if you want the ability for your corporation to raise $5,000, then perhaps you authorize the corporation to issue 1000 shares at an initial part value of $5 per share. Your state fee in this case will be $58.

- LLCs are not required to file a registration report with the Missouri Secretary of State, but corporations must file annually. The annual report is due three months after the end of the registration anniversary month. So if you incorporated or foreign-qualified on March 15th, then your annual report is due every by June 30th.