Nonprofit Articles of Incorporation

Your nonprofit articles of incorporation is a legal document filed with the secretary of state to create your nonprofit corporation. This process is called incorporating. In some states, the articles of incorporation is called a certificate of incorporation or corporate charter.

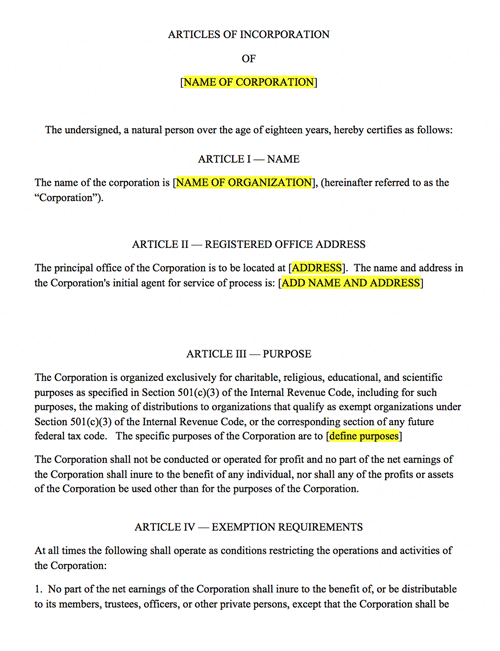

Free Nonprofit Articles of Incorporation Template!

Download Our Free Microsoft Word Template

This articles of incorporation template was drafted by an attorney and contains 501(c)(3) provisions. This document is intended to be used as a sample or model only. Some of the information provided in this template may or may not fit the needs of a specific organization. Use of this template should not be construed as legal counsel or substitute the advice of an attorney.

Incorporating provides several important benefits:

- It registers your organization’s name.

- It limits the personal liability of the directors and members.

- It adds credibility to the organization.

- It paves the way to applying for 501(c) federal tax exemption.

After you have secured your corporate name by filing and receiving state approval of the Articles of Incorporation, you can use the name to apply for a Federal Employer Identification Number (FEIN), obtain business licenses, and sign contracts.

If you are following this guide sequentially, then you have the following inputs already prepared for your Articles of Incorporation:

- The specific type of nonprofit legal entity you wish to form.

- The specific 501(c) tax exemption your nonprofit will apply for, if any.

- The names of your initial board of directors.

In most states, the secretary of state oversees corporations. Most state websites offer articles of incorporation templates and instructions. If your state’s template is not available, you may use our free template as a starting point. The secretary of state will approve your articles of incorporation if they contain the minimum amount of information required by the state’s corporations code, but there can be further provisions that you should include. Not all articles of incorporation templates contain provisions required for 501(c)(3) eligibility. State tax exemptions, certain banking purposes, and government agencies may require additional language in the articles of incorporation. To prevent delays and additional costs, know all of the requirements for your formation before filing the articles of incorporation.

Filing your articles of incorporation does not require an attorney. Anyone can act as the incorporator. State fees to process your articles of incorporation may range from $50 - $400 and processing time typically takes 2 - 4 weeks. Some states offer expedited filing for an additional fee. If a filing is rejected, it may add up to a month to the process.

In some states, nonprofit corporations are required to publish notice of their intention to file or their filing of the Articles of Incorporation. Research and abide by the publication requirements in your state. Typically, specific language is required and there are guidelines about which legal publications or newspapers should be used. You should make sure to obtain legal affidavits providing proof of publishing from the newspapers and keep them in your corporate records. The cost of publishing is typically around $200 but may vary by length of copy and newspaper.

Key Takeaways:

- Incorporating your nonprofit secures your corporate name, limits the personal liability of directors, and adds credibility to the organization.

- Your secretary of state will approve your articles of incorporation if they contain the minimum requirements, but additional provisions may be required for 501(c) eligibility.

- Some states may require you to publish notice of your intent to file or filing of articles of incorporation.

Start Your Nonprofit