-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

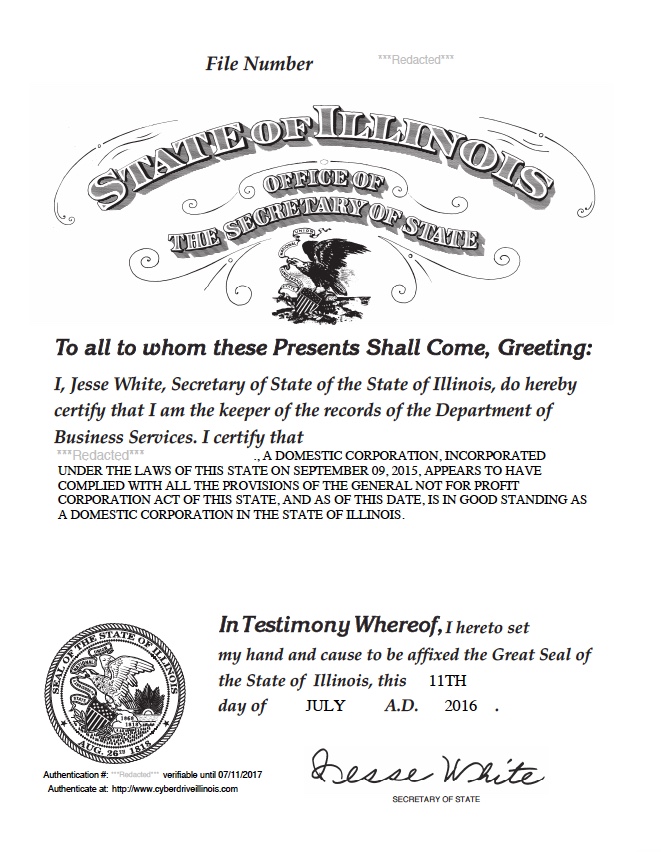

Illinois Certificate of Good Standing

Obtaining a Certificate of Good Standing from time to time is a normal part of conducting business,.

Certificate of Good Standing for Limited Liability Companies:

| Agency: | Illinois Secretary of State - Business Services Department |

| Form: | |

| Filing Method: | Mail, fax, email, or online. |

| Agency Fee: | $25 for standard processing and $45 for expedited processing. |

Certificate of Good Standing for Corporations:

| Agency: | Illinois Secretary of State - Business Services Department |

| Form: | Corporate Request Form For Certificates Of Good Standing And/Or Copies Of Documents |

| Filing Method: | Mail, fax, email, or online. |

| Agency Fee: | $25 for standard processing and $45 for expedited processing. |

Certificate of Good Standing for Nonprofit Corporations:

| Agency: | Illinois Secretary of State - Business Services Department |

| Form: | Corporate Request Form For Certificates Of Good Standing And/Or Copies Of Documents |

| Filing Method: | Mail, fax, email, or online. |

| Agency Fee: | $5 for standard processing and $15 for expedited processing. |

Certificate of Good Standing for Professional Corporations:

| Agency: | Illinois Secretary of State - Business Services Department |

| Form: | Corporate Request Form For Certificates Of Good Standing And/Or Copies Of Documents |

| Filing Method: | Mail, fax, email, or online. |

| Agency Fee: | $25 for standard processing and $45 for expedited processing. |

Learn about obtaining a certificate of good standing in other states:

Please note that in Washington, North Dakota, South Dakota, and New Hampshire, the certificate contains a raised seal, so you likely need a mailed copy of the certificate.

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of

Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Illinois Certificate of Good Standing, Illinois Certificate of Existence, Illinois Certificate of Status