How to File PA Nonprofit Articles of Incorporation

You can form a Pennsylvania nonprofit corporation or a nonprofit cooperative corporation by filing the articles of incorporation intended for a nonprofit.

| Type of Corporation | Link to Template |

|---|---|

| Domestic nonprofit corporation | template |

| Domestic nonprofit cooperative corporation | template |

1

Type of entity

You will specify whether you are incorporating a nonprofit corporations or a nonprofit cooperative corporation on your articles.

2

Name

Corporate names must be distinguishable from all other registered entities in Pennsylvania. It is important that you conduct a thorough name availability check before filing your articles of incorporation. Certain words cannot be used in corporate names without first obtaining government approval such as words referencing professional licensing (e.g., accounting).

3

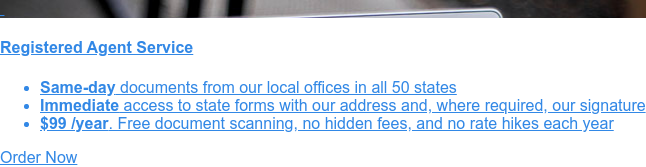

Registered office

You are required to specify your registered office on your Pennsylvania articles of incorporation. A registered office is where your company receives service of process (notice of a lawsuit) or other important legal documents. You may use any physical address in Pennsylvania that is not a PO Box. You can also use a commercial registered office provider (CROP), which is a company that serves on your behalf. If you have a home office, are regularly out of the office, or wish to have added privacy of keeping your address off the public record, then using a CROP may be in your interest.

4

Incorporators

Your corporation must have at least one incorporator but may have more. An incorporator is the individual responsible for executing the articles of incorporation. An incorporator may be any natural person of full age (18 years old) or a corporation. For any incorporator you list, you must include the incorporator’s name, address, and signature.

5

Stock or non-stock

Nonprofits are organized on a non-stock basis, meaning no ownership shares are issued. In the event of

dissolution, surplus monies are donated to another nonprofit. If the corporation is a nonprofit, you

should include a statement that the corporation is organized on a non-stock basis.

Nonprofit cooperatives may be organized on a stock or non-stock basis. Cooperatives that issue stock

have shareholders. If the corporation is a cooperative, you should include a statement indicating

whether it is organized on a stock or non-stock basis. Owning stock in a cooperative gives the

shareholder/member the right to vote in company matters such as electing the board of directors.

6

Members

A nonprofit may choose whether or not to have members. Members elect the board of directors and provide a

layer of oversight that is important to many nonprofits, especially larger ones. Having members comes

with added complexity in management, recordkeeping, and maintenance.

You should indicate whether or not your nonprofit has members. If there are members, you should include

a statement that the majority of the members of the committee authorized to incorporate the nonprofit

have made the vote required to authorize the incorporation.

A nonprofit cooperative that is organized on a stock share basis has shareholders. If it is not

organized on a stock share basis, then it has members. A cooperative should indicate whether or not it

is organized on a stock share basis and what common bond of membership exists among the members or

shareholders.

7

Directors

Directors are the individuals elected by the shareholders or members to oversee the management of the corporation. Nonprofits that do not members typically have self-perpetuating boards, meaning the board of directors itself elects new directors to fill vacancies in the board. The board of directors elects corporate officers to run the day-to-day operations and make certain decisions for the corporation. Your corporation must have at least one director but you are not required to list directors in the articles of incorporation.

8

Officers

Officers run the day-to-day operations of the corporation. You must have a president and a secretary. One person can hold both offices. You may also choose to have a treasurer and a vice president. Officers are not required to be listed in the Pennsylvania articles of incorporation.

9

Effective date

By default, your corporation will become effective on the date the Pennsylvania Department of State processes your articles of incorporation. You may list a future date if desired.

10

Other provisions required by the Department of State

You must include a statement that the nonprofit is incorporated under the provisions of the Nonprofit Corporation Law of 1988 and for what purpose(s). You must also include a statement that the nonprofit does not contemplate pecuniary gain or profit.

*

Provisions required for 501(c)(3) eligibility

If you are looking to become a 501(c)(3) tax exempt organization, you will need to include statements to the effect of the following:

- The corporation is not for profit

- It will not engage in prohibited political or legislative activity listed in 501(c)(3)

- If dissolved, it will distribute its assets in compliance with 501(c)(3)

*

Provisions required for Pennsylvania sales tax exemption

Nonprofits that wish to apply for Pennsylvania sales tax exemption may also wish to include a statement prohibiting the use of surplus funds for private inurement to any person in the event of a sale or dissolution of the entity.

*

Optional provisions

You may choose to include more information about your nonprofit such as the names and addresses of the

initial directors.

How to Register for Nonprofit Taxes and Exemptions

Federal income tax exemption

Nonprofits may choose to apply for federal income tax exemption. The IRS published rev-557, an informational resource on how to obtain tax exempt status for a nonprofit organization. 501(c)(3) is perhaps the most common and well-known tax exemption category for charitable organizations, however the internal revenue code has exemption categories for many other types of nonprofits organizations.

Pennsylvania fundraising registration

Nonprofits that solicit funds from Pennsylvania residents may need to submit registrations with the PA Department of State Bureau of Charitable Organizations. The Charitable Organization Registration Statement and the Institution of Purely Public Charity Registration Statement are two forms that are filed by many Pennsylvania nonprofits. Certain organizations are exempt from filing these documents, including those that collect less than $25,000 in donations per year and have annual program service revenue of less than $5,000,000. Certain religious organizations are also exempt.

Pennsylvania sales tax exemption

Nonprofits can apply to become exempt from paying sales tax in Pennsylvania by filing form rev-72 – Application for Sales Tax Exemption.

More filings may also be necessary depending on the specific situation of a nonprofit.