-

Software

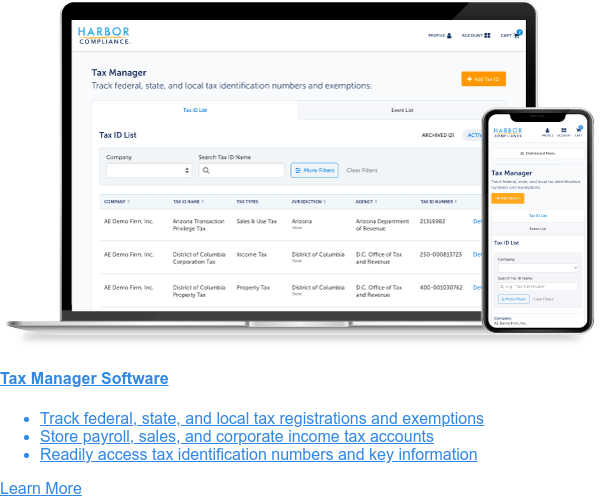

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

Florida Payroll Licensing

Licensing requirements for Florida employers.

Harbor Compliance provides payroll tax registration services in every state to help your company hire employees and process payroll on time.

In most states, the two payroll taxes are withholding and unemployment insurance (aka unemployment tax and unemployment compensation). Employers must register for the appropriate accounts in order to hire employees, to process payroll, and to file tax returns. Given the virtual, home-based, and temporary nature of employees, registrations often take place on short notice and in multiple states. Foreign qualification and registered agent are prerequisites in most states.

Employer Witholding Tax Licensure

This section applies to employers that are applying for a license in Florida for the first time to withold taxes from payroll.

Not required

Florida does not have a statewide individual income tax and therefore does not collect a withholding tax.

Unemployment Tax Licensure

This section applies to employers that are applying for a license in Florida for the first time for unemployment insurance.

| Agency: | Florida Department of Revenue |

| Form: | |

| Filing Method: | Form |