-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

Released April 2, 2019

Harbor Compliance Releases Ultimate Guide to Foreign Qualification

Details Registration Requirements for Businesses and Nonprofits

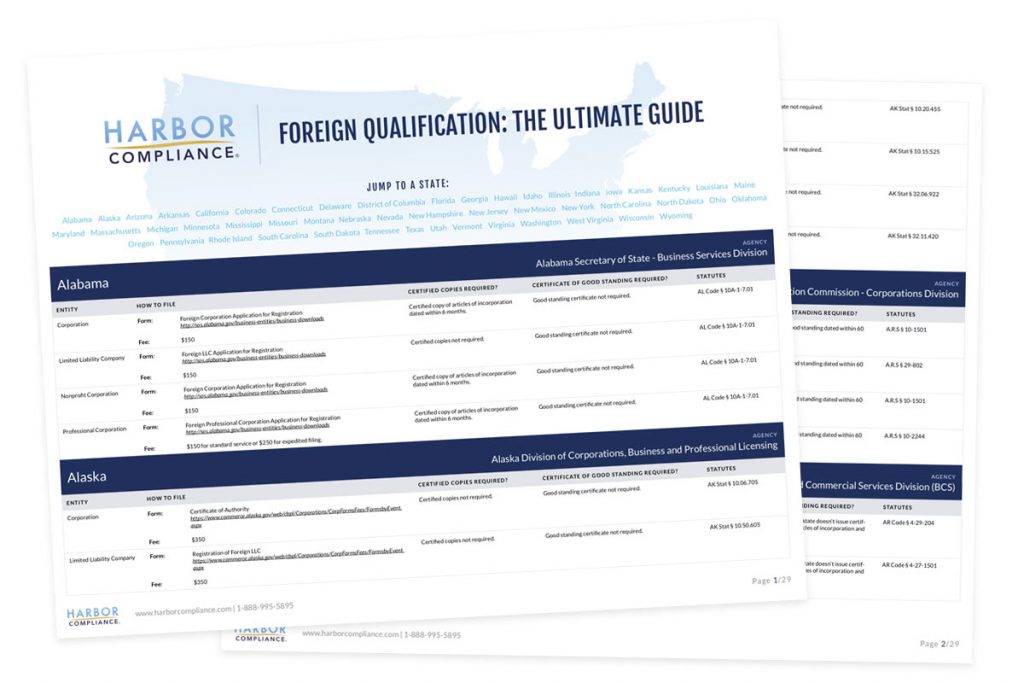

This week Harbor Compliance released Foreign Qualification: The Ultimate Guide, a reference to help businesses and nonprofits expand beyond their states of formation.

Whenever organizations want to expand to new states, they have to register with the secretary of state, a process called foreign qualification. The requirements and steps to foreign qualify are different in each state, which presents challenges for growing organizations. This guide breaks down the fees, deadlines, and application requirements in every state.

Foreign qualification is generally required to open facilities, hire employees, and purchase property in new states. It is also frequently required when providing goods and services or conducting regulated activities. Over the past several years, states have been expanding these requirements.

“More and more, foreign qualification is being required as part of other registrations,” said John Beck, Harbor Compliance Director of Market Strategy. “For example, more professional licensing boards are including foreign qualification requirements as part of the licensing application process. We’re also seeing an increase in inquiries from retailers that are reassessing their sales tax obligations in the wake of the 2018 South Dakota vs. Wayfair decision, which affects their need to qualify.”

Foreign Qualification: The Ultimate Guide details requirements for every entity type, from limited liability companies and corporations to partnerships and nonprofits. Download the guide here.

Harbor Compliance has published a companion piece, Annual Reports: The Ultimate Guide, to help businesses and nonprofits file timely annual reports to keep their entities in good standing. The guide outlines filing instructions and deadlines, state contact information, and links to application forms in all 50 states plus D.C.

Both guides are featured in the company’s Information Center, which comprises 4,000 pages of free licensing, tax, and entity management resources for businesses, nonprofits, and professional services firms.

About Harbor Compliance

Founded by a team of licensing specialists and technology trailblazers, Harbor Compliance empowers businesses and nonprofits with licensing, tax, and entity management solutions. Through a unique combination of dynamic data, advanced compliance software, and expert service options, the company helps organizations thrive and grow through every phase of the corporate lifecycle. The company’s headquarters are located at 1830 Colonial Village Lane, Lancaster, Pennsylvania. To learn more, visit www.harborcompliance.com, or call 1-888-995-5895.