-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

Released May 7, 2020

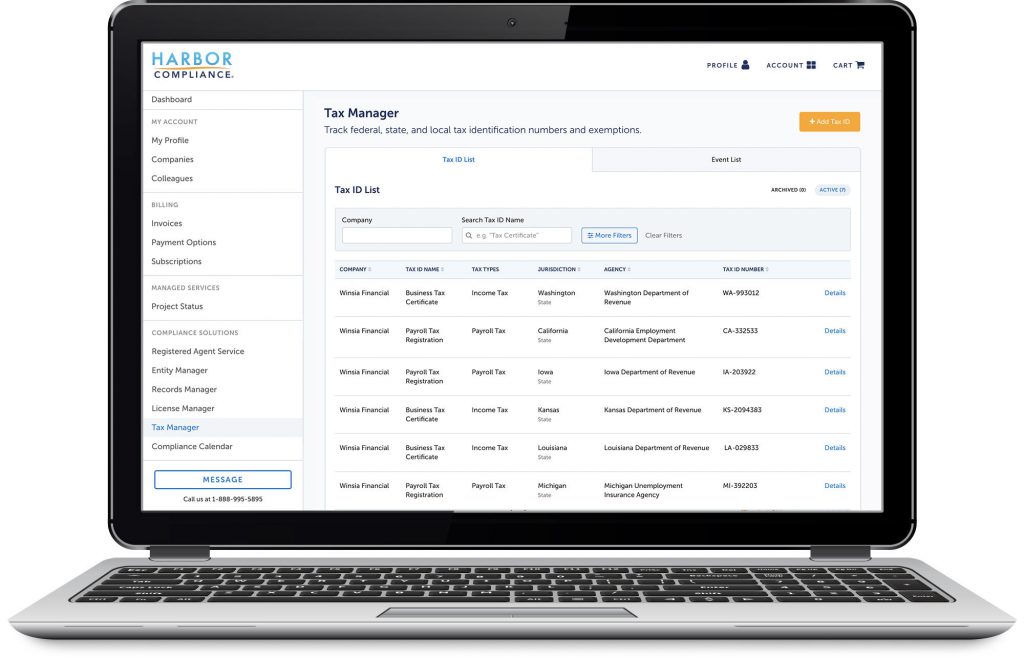

Harbor Compliance Launches Tax Manager Software

Maintain your federal, state, and local tax registrations and exemptions.

LANCASTER, Pa. May 7, 2020 – This week Harbor Compliance launched Tax Manager to provide organizations with a solution for managing tax registrations with federal, state, and local revenue departments.

Tax Manager is the newest module within Harbor Compliance’s already expansive compliance software suite. With Tax Manager, organizations can easily view where they are registered, access tax identification numbers and key data, store certificates and agency correspondence, and track events and renewal reminders.

The recent U.S. Supreme Court decision in Wayfair versus South Dakota opened the door to significant expansions of state sales tax obligations. The ruling allows states to require online retailers and interstate businesses to pay sales tax on purchases made by residents of those states, regardless of the business’ physical presence, or lack thereof.

As the regulatory landscape continues to change, Tax Manager helps ease the challenge. “In light of the Wayfair versus South Dakota ruling, organizations often struggle to keep track of where they are or are not properly registered for tax purposes. This includes all common tax types: corporate income tax, sales tax, payroll tax, and exemptions. Storing the tax identification numbers in one place where they can be readily accessed makes it easier when they receive requests for this information from accountants, payroll vendors, or government agencies. That’s where Tax Manager comes in,” said John Beck, Harbor Compliance Director of Market Strategy. “Having a system to reliably store and readily access tax registration information provides organizations with efficiency, eliminates duplication, and minimizes risk.”

Tax Manager acts as a consolidated hub for important tax registration information. The software will allow you to track filing events and assign colleagues to receive renewal reminders. Additional features include the ability to store important documents such as registration certificates and agency correspondence for easy access and improved continuity.

The functionality of Tax Manager allows you to reduce risks related to tax registration gaps and lapses and drastically cut down staff time spent managing registrations. Tax Manager will help your organization maintain compliance with the Department of Revenue. Within our software suite, we also have Entity Manager and License Manager, which allow your organization to better manage your compliance with the Secretary of State and Licensing Board respectively. The most recently launched software module, Records Manager, tracks critical documents and company records. When our software suite is combined, you can expect greater productivity, streamlined workflows, and clear accountability. To learn more about Tax Manager and the entire compliance software suite, schedule an online demonstration with a Harbor Compliance representative today.

About Harbor Compliance

Founded by a team of government licensing specialists and technology trailblazers, Harbor Compliance is a leading provider of comprehensive compliance solutions for businesses and nonprofits nationwide. Since 2012, we have helped more than 25,000 businesses and nonprofit organizations apply for, secure, and maintain licensing across all industries and activities. The company’s headquarters are located at 1830 Colonial Village Lane, Lancaster, Pennsylvania. To learn more, visit www.harborcompliance.com, or call 1-888-995-5895.