Dynamic Disclosures™

Automate State Compliance and Safeguard Donor Trust

Access to the only tool designed for nonprofits to meet ever-changing state disclosure requirements.

- Strengthen and simplify your managed charitable solicitation registration compliance

- Actively update fundraising disclosure language directly on donation webpages

- Build donor trust and increase the effectiveness of your fundraising appeals

Why Charitable Solicitation Disclosures Matter

Like your organization’s written appeals, your website, email newsletters, and email solicitations are powerful tools to generate mission awareness and raise funds.

Most states regulate traditional and online fundraising methods. In addition to annual charitable solicitation registration, 25 states require nonprofits to include state-specific disclosure statements on their website donation pages, solicitations, and donor correspondence. Disclosure statements serve to educate the public about the organization, its leadership, and financial standing.

State disclosure requirements change frequently, resulting in wasted capacity maintaining web pages with static text. Dynamic Disclosures offers a simpler, automated way to comply with the statutory language in every state.

donors research nonprofits online before they give.

Help your donors make informed giving decisions by providing them with important information about your organization.

Sourceof state regulators regularly conduct online research on nonprofits.

Demonstrate your organization’s accountability and avoid state enforcement violations.

SourceA Compliance Solution for Modern Fundraising Efforts

Solicitation disclosure compliance requires constant vigilance. Our Dynamic Disclosures tool tracks changes in state requirements, organization registration status, and contact information—and automatically updates your website.

As your organization engages with more donors in innovative ways, Dynamic Disclosures is the innovative solution for efficiently complying with state registration requirements.

How Dynamic Disclosures Works

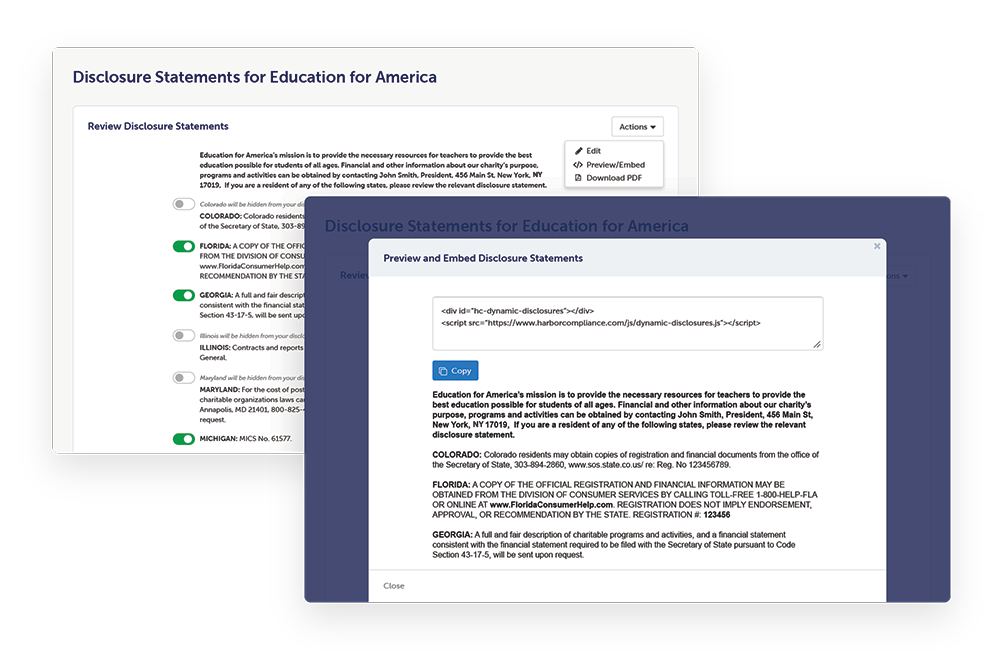

Powered by our proprietary requirements database, Dynamic Disclosures tracks state requirement changes and automatically updates your website.

Embed the code in your website one time.

Our compliance team assists you with implementation and training.

Easily make changes without website technical support.

Update organization contact information and toggle disclosures for individual states on and off as needed.

Confidently publish donation webpages.

Disclosure statements are readily visible at the point of your website solicitations. Separately, export and download disclosure statements at any time for inclusion in printed and email solicitations.

Frequently Asked Questions

Fundraising disclosure statements must be readily available for donors to review. While the exact placement and text of each statement varies by state, organizations can broadly expect to include disclosures in the following situations:

- On written fundraising appeals, such as letters, emails, and newsletters

- On websites and online donation forms

- In donor acknowledgements and follow-up requests such as pledge reminders

- In any other place where the residents of a given state may be prompted to donate

The IRS requires organizations that receive a charitable contribution exceeding $250 to provide a written acknowledgment to the donor. This federal disclosure requirement is different and separate from state charitable solicitation disclosures. Organizations should take care to include and use all required disclosures where applicable.

Yes, our Dynamic Disclosures tool allows you to export state disclosure statements for use on your non-web solicitation materials, such as written appeals and email newsletters. Note, Dynamic Disclosures does not automatically update your non-web solicitation materials.

Contact Us

Learn how our compliance solutions help your organization meet state charitable solicitation requirements, save time, and build donor trust.