-

Software

Compliance Software

Businesses and nonprofits can oversee licenses, track renewals, access documents, and more from a single interface.

Software OverviewSoftware Features -

Services

Compliance Services

Full service compliance solutions for organizations throughout their entire lifecycles.

Business Overview Nonprofit Overview -

Industries

Industry Services

Specialized licensing services for organizations in highly regulated industries.

General BusinessIndustries - Information Center

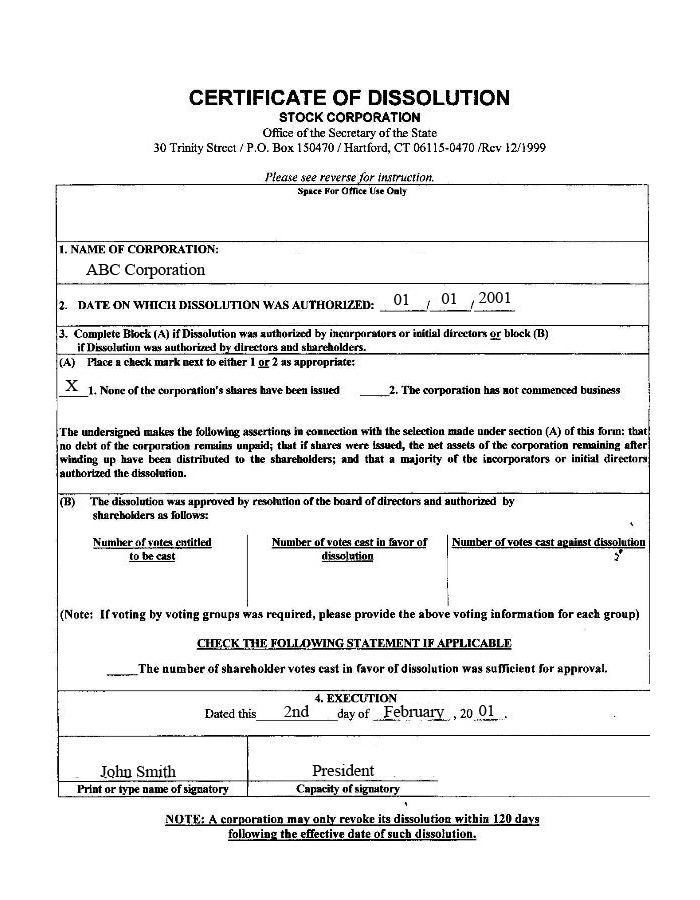

Company Dissolution

Services to terminate your company’s legal existence with the state.

- Manage your corporate dissolution with the secretary of state.

- Prepare and file your articles or certificate of dissolution.

- Obtain tax clearance and submit overdue annual reports for an additional flat fee.

The Harbor Compliance Advantage

Trusted by attorneys and businesses nationwide. Get access to our expertise in corporate filings and compliance in all 50 states.

Upfront and affordable pricing. Rest assured that you will not be billed hidden fees or other unexpected charges.

Single point of contact. A knowledgeable specialist is assigned to your account to submit your filings and help you stay compliant.

Dissolve your LLC or corporation

If your business will no longer be operating in its home state, or the state in which you formed the entity, dissolving the entity officially terminates your company’s affairs in a state.

Generally, dissolving a business entity requires obtaining tax clearance from the Department of Revenue and filing Articles of Dissolution with the Department of State.

Harbor Compliance makes dissolving your business painless. We will prepare the necessary forms and can obtain tax clearance for your business, as you end business operations.

Our Process

Harbor Compliance helps you dissolve your business. We simplify the process by assisting you with the following:

- Contact the Secretary of State and Department of Revenue to understand your entity’s dissolution requirements

- Determine any past due filings, including annual reports

- Identify filings required to dissolve and the associated fees and penalties

- Prepare and file Articles of Dissolution with the state

- Provide the exact service fees for Harbor Compliance to prepare and submit additional filings

We can also assist with the following:

- Obtaining tax clearance for your business

- Filing overdue annual reports

- Serving as registered agent for the dissolution process

How we help

Dissolving a business requires filing with the Secretary of State, and often with the Department of Revenue or Taxation. Researching your business’ unique requirements, and preparing all of the filings takes hours of your executives’ time. Dissolution services from Harbor Compliance save you time as you wind up company affairs.

When you sign up for our service, a corporate filing specialist contacts you within one business day. We contact various state agencies on your behalf to identify the exact steps necessary to dissolve your business. Your specialist informs you of additional filing fees and our flat fees to prepare and file your applications. Your specialist completes each necessary step and sends you confirmation when your business has been dissolved.

Common Questions

What is Tax Clearance?

Depending on your state, and the type of entity you are dissolving, you may be required to obtain tax clearance from your state’s Department of Revenue or taxation authority. If this is required, you can add this to your service, and a Harbor Compliance specialist will obtain tax clearance for your business.

Dissolution vs. Withdrawal

The term “dissolution” typically refers to domestic entities who are winding up affairs in their home state, and shutting their doors. If you have an out-of-state entity, and wish to wrap up affairs in that state, you will “withdraw” from the state or “cancel” your foreign registration. For more information on withdrawing your entity, please visit our service page.

Why do I need to dissolve my business?

As companies go out of business, often the last thing on their mind is filing dissolution paperwork with the state. As a result, many businesses are administratively (or involuntarily) dissolved by the state for failure to maintain good standing, or to keep up with compliance requirements.

Companies that are involuntarily dissolved often face state penalties, and the owners face a loss of liability protection. Entities that are not in good standing also run the risk of default judgment in court.

Filing dissolution paperwork with the state ends the life of your corporate entity cleanly, and reduces your risk of penalties, as you wrap up your day-to-day business affairs.

Why should I use Harbor Compliance to dissolve my business?

Dissolving your business can take weeks, even months, as you wind up business affairs, and file with multiple government agencies. Harbor Compliance specializes in navigating this process, and will complete your government filings as you terminate affairs.